On this page

Your Revolve account

Want to learn more about what you can do with your account? We want to make the way you bank and spend money as simple as possible. So we’ve gathered all the information about the features of your Revolve account, in one place.

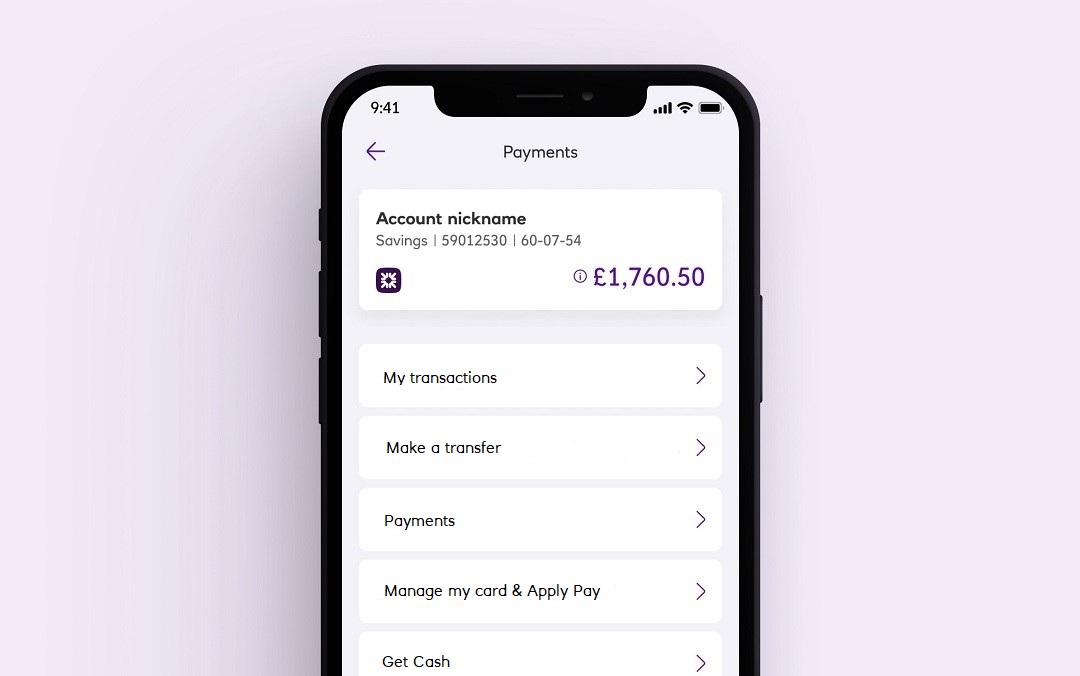

View your bank account on the go

Check your accounts and balance anytime. View your recent transactions and transfer money between your own accounts.

Once you are 13 or older, you can make payments to saved payees and pay someone new without a card reader (limits apply) .

Get cash without your card

If you have at least £10 available in your account and your debit card is active, you can get cash without your card.

You can withdraw up to £130 every 24 hours from our branded ATMs. Simply log in to your app, click your current account tile and click 'Get Cash'.

Pay in cheques securely

Just take a photo of the front and back of the cheque using our app and the money will be paid into your account.

Limits apply.

App available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Download the Royal Bank app

- On your mobile or tablet, open the camera and point your device at the QR code.

- A link will pop up, tap this, and you’ll be taken straight to download the app.

QR code not working?

Don’t worry, you can still download the app by following these instructions:

- On your mobile or tablet, go to the App Store if using Apple or Google Play if using Android.

- Search for 'Royal Bank of Scotland Mobile Banking'.

- Tap to download the app.

Activate your card

How to activate your card.

If you're new to Royal Bank of Scotland, we'll post your contactless debit card and PIN separately within a few days of opening your account. Once your card arrives we'll explain how to activate it.

If your existing card is not contactless and you have an eligible account, you can request a new card. This gives you a quick and simple way to make purchases. Retailer limits apply.

Set up your digital wallet

Your digital wallet allows you to pay using your phone. You can use Apple Pay or Google Pay™ for an easy and secure way to pay. Retailer limits may apply.

Apple Pay and Google Pay only available to customers aged 13+ with compatible iOS and Android devices.

Apple Pay

Find out how to set up Apple Pay so you can make payments using your Apple device.

Google Pay

Find out how to set up Google Pay so you can make payments using your Google device.

Our student bank account

Our Student bank account is a current account designed for those heading off to further education aged 17+, and comes with:

- Student offer. T&Cs apply.

- Up to £2,000 Interest-free arranged overdraft from year one (limited to £500 in your first term).

- You can apply for up to £3,250 interest free from year three onwards.

Eligibility criteria apply.

Overdraft subject to approval. 18+.

Start saving for your #lifegoals

- From your next set of wheels, a holiday with your mates or your first home, we could have a savings account for you.

- Whether you're new to saving or have been putting your pocket money away since you were little, we have a range of savings options.

Eligibility criteria apply.

Manage your account with digital banking

Digital banking is a secure, easy to use and convenient way to manage your account. With digital banking you can:

- View your balance.

- Make payments. (16 and over only)

- Transfer money between your accounts.

- Set up and go paperless.

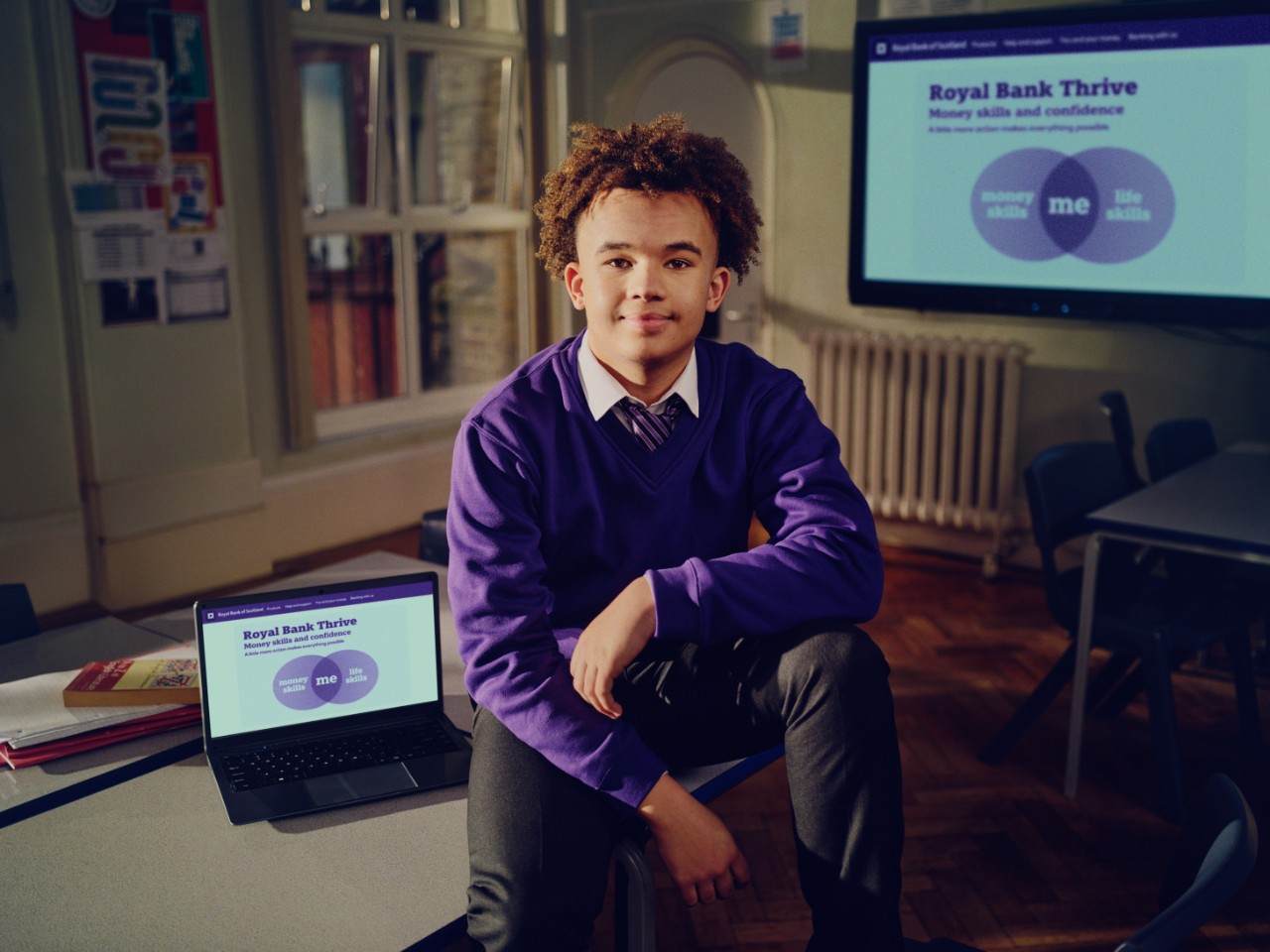

Build money confidence

Let’s make your kids’ dreams come true. Royal Bank Thrive is a movement to help young people develop the self-belief, confidence and skills to achieve their goals.