Fancy boosting your interest rate?

Switch to Royal Bank and you could get £150 and access to a 12 month fixed bonus rate if you open a Digital Regular Saver account.

Offer available to new and existing customers who haven't previously recieved a switch offer and did not hold a Royal Bank current account or savings account as of 17 February 2026.

How to get £150

1. Open a current account and switch to us

- Apply for a Select or Reward account and request to switch an account with another bank to us using the Current Account Switch Service by 28 May 2026.

- Your switch must be completed by 16 June 2026.

2. Within 60 days of switching

- Pay in £1,250 - This can be made of multiple payments and must remain in the account for 24 hours.

- Log in to our mobile app - This can be done on any device that supports the Royal Bank mobile banking app.

3. You're all set

When you've met these conditions, we'll pay £150 into your eligible account within 30 days.

How to unlock our bonus rate

Once you've opened your current account, you must open a Digital Regular Saver by 16 June 2026. To be eligible for the bonus rate, you need complete your switch to us.

- 7% AER

This includes 5.25% / 5.13% AER/Gross p.a. (variable) on balances up to £5k plus a conditional bonus of 1.75% AER (fixed) for 12 months. Interest paid monthly. - 1.00% AER/Gross p.a. (variable) on balances over £5,000.

There’s no need to wait for your £150 incentive to be paid.

Why choose a Digital Regular Saver?

- Save between £1 and £150 each month - you're in control.

- Instant access to your savings whenever you need them.

- Perfect for building regular savings habit, whether you're starting small or levelling up your savings goals.

Specific account eligibility criteria & conditions apply. Monthly account fees may apply. Offer T&Cs and restrictions apply. You are not eligible for this offer if you're switching a current account from NatWest Group (NatWest or Ulster Bank NI). Joint accounts are not eligible for this offer. This offer may be changed, replaced, or withdrawn at any time.

Kick off your savings habit

Open your account & set up a standing order to regularly pay in £1-£150 each month when you open your account.

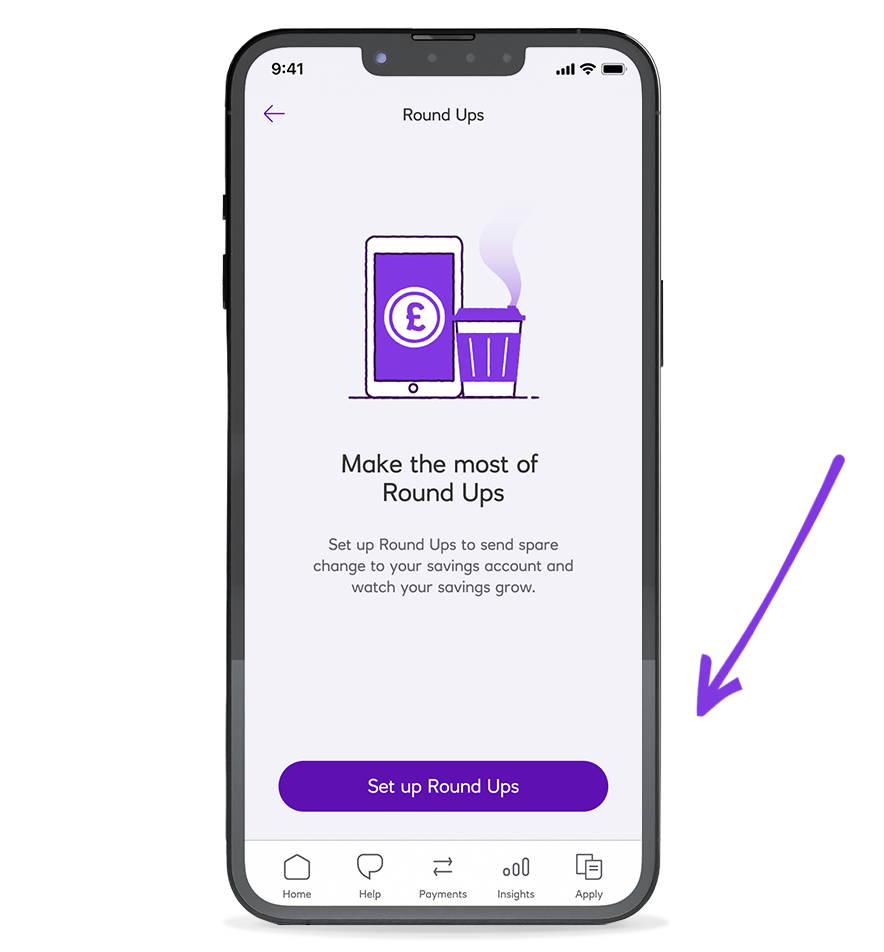

Top up with Round Ups

Round Ups don't count towards your monthly limit, so you can top up your Digital Regular Saver with the spare change every time you spend on your debit card.

Flex your saving to suit you

You can change your standing order whenever you need to, or top-up your monthly contribution if you haven't already hit your £150 limit for the month.

Discover amazing features on our mobile app

Eligibility criteria and conditions apply.

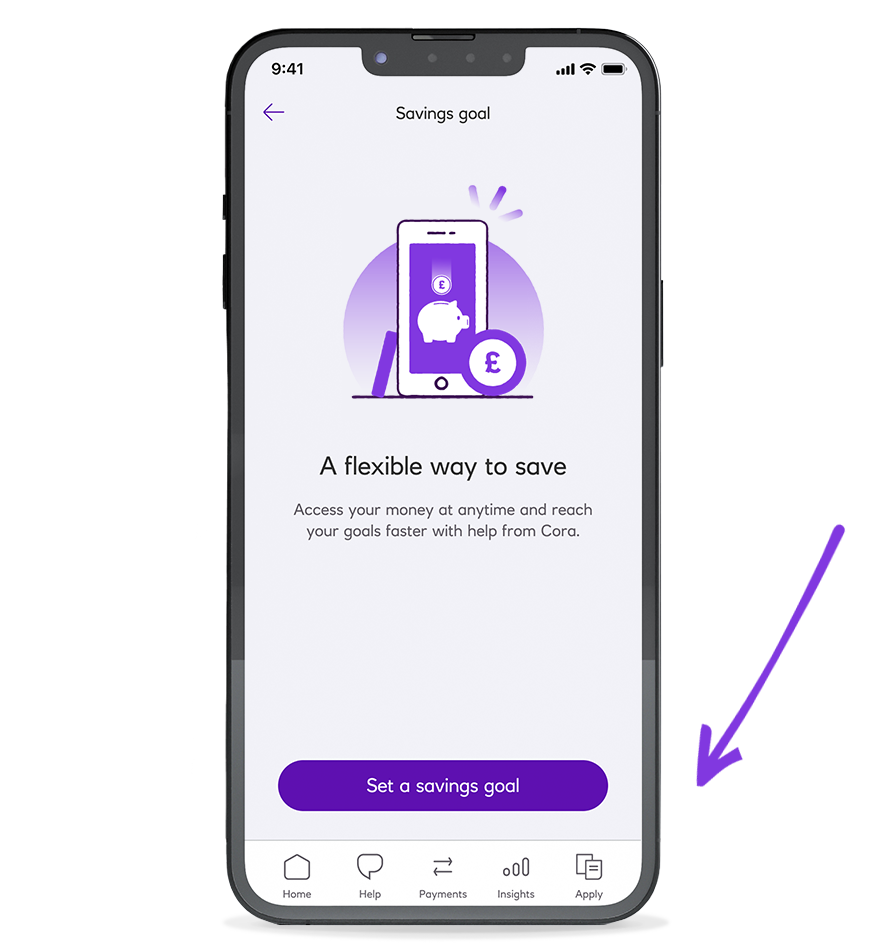

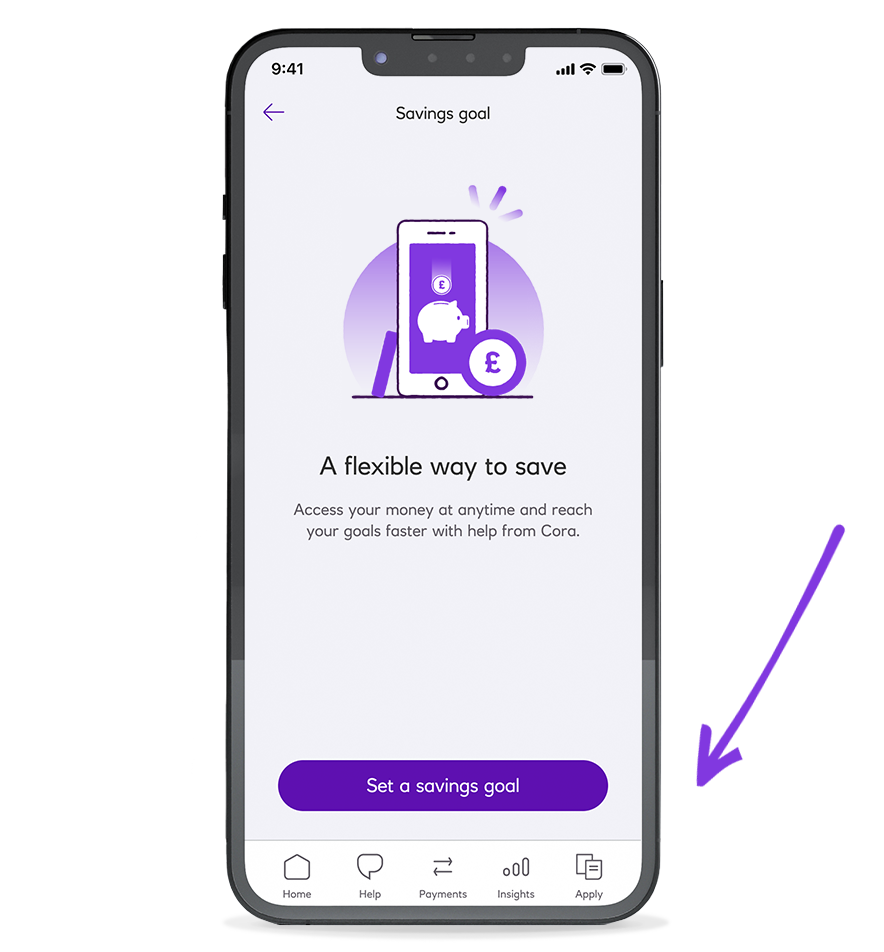

Set savings goals

Set yourself up for success with a savings goal.

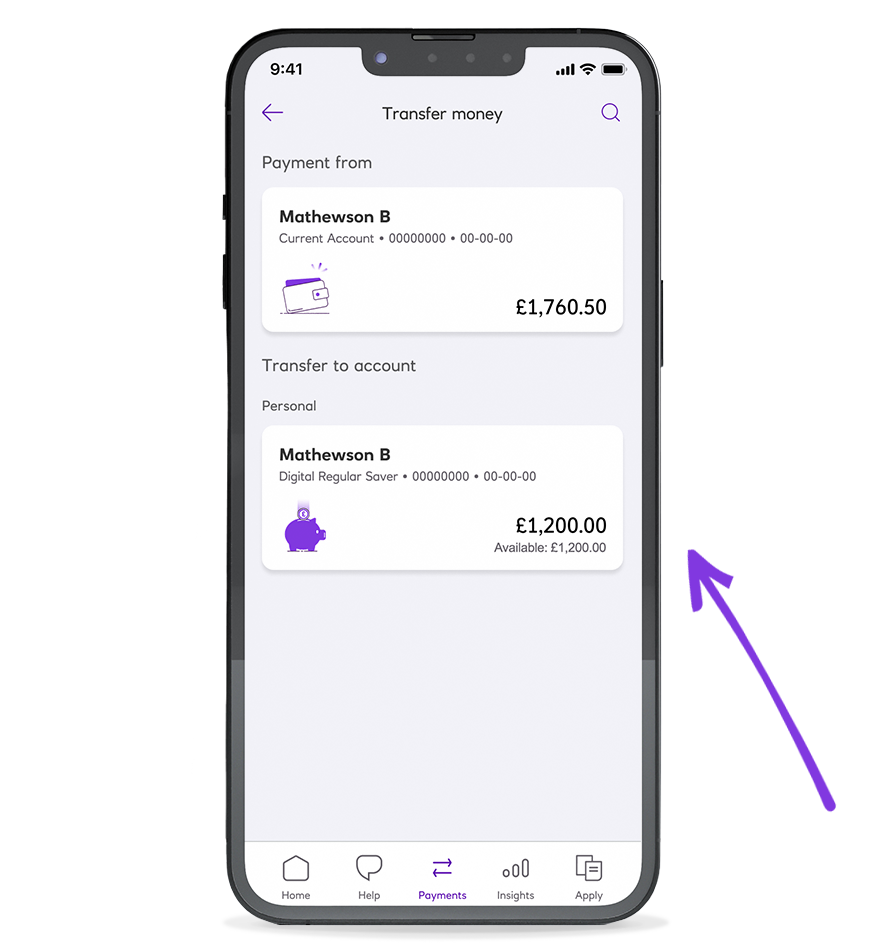

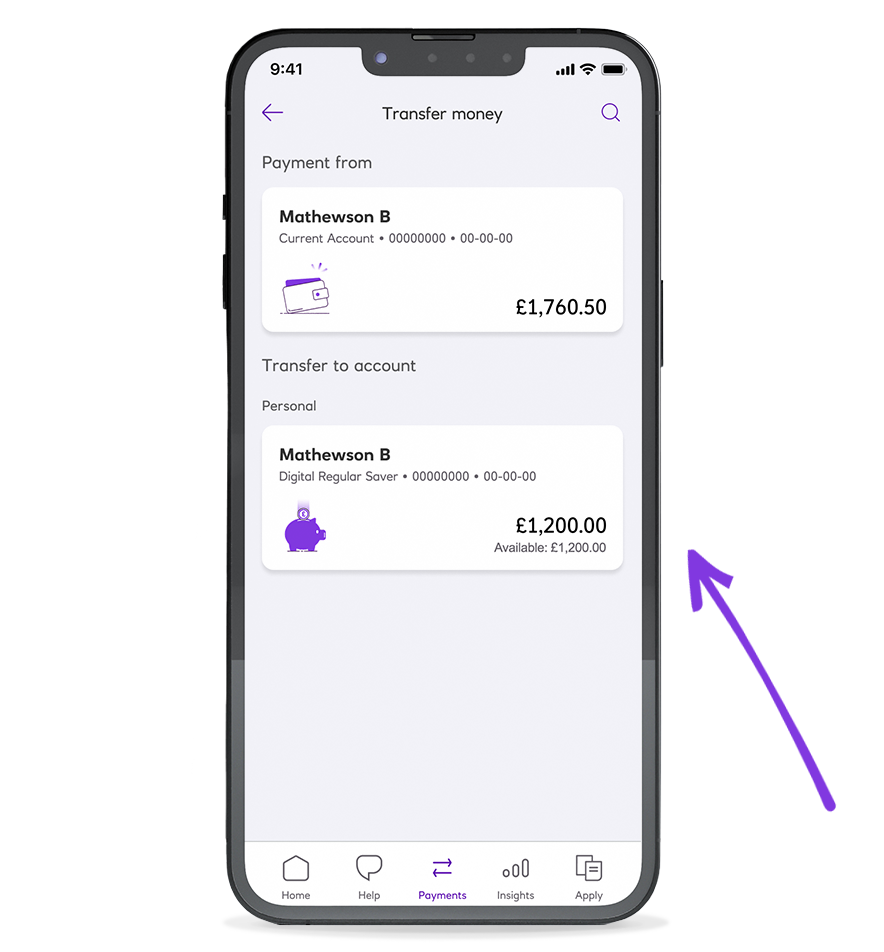

Transfer money in seconds

Transfer money between your current and savings accounts, on the go, any time.

Round Ups

Round up your spending to the nearest £, sending the change (or up to five times that) to your savings.

Discover amazing features on our mobile app

Eligibility criteria and conditions apply.

Eligible current and savings account required. Conditions and app criteria apply.

What is the interest rate?

Frequently asked questions

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. Please take some time to review, print and/or save the important information.