Individual account eligibility criteria and conditions may apply.

There' still time for this year's ISA allowance

You have until 02 April to open a Royal Bank cash ISA and make the most of this year's £20,000 ISA allowance.

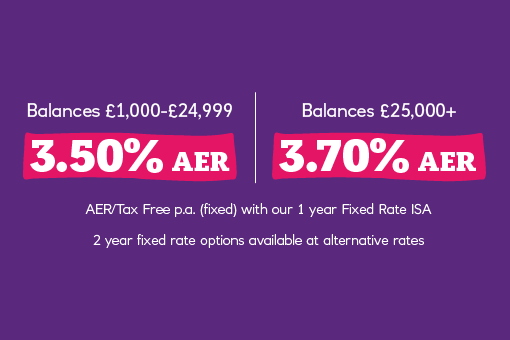

Rates up to 3.50% AER/tax-free p.a. (fixed) on balances from £1,000 - £24,999 or 3.70% AER/tax-free p.a. (fixed) on balances £25,000+ if you fix with our one year Fixed Rate ISA.

Two-year Fixed Rate ISA also available at alternative rates. Interest paid annually. Or explore our instant access Cash ISA and start saving from as little as £1,

See product information below. Specific eligbility criteria and early closer charges may apply.

Digital Regular Saver (Switch offer live)

5.25% AER / 5.13% Gross p.a. (variable) on balances up to £5,000, 1.00% AER / 1.00% Gross p.a. (variable) on balances over £5,000.

Eligible current and savings account required. Conditions and app criteria apply. Exclusively for current account customers, aged 16 and over. UK residents only.

Switch offer available to new and existing customers who did not hold a Royal Bank current account or savings account as of 17 February 2026. T&Cs and restrictions apply.

ISAs

Make the most of your £20,000 ISA allowance for the current tax year

You can only hold one Instant Access ISA with the Royal Bank of Scotland. You must be a UK resident aged 18+. Tax free interest means interest payable is exempt from UK Income Tax.

Instant Access ISA

Great for tax-free flexible saving

Enjoy tax-free interest on your savings up to £20,000

Open with as little as £1 and top up on the go

Access your money anytime, anywhere

Fixed Rate ISA

Tax-free savings on balances starting from £1000

Any interest earned won't be taxed up to £20,000 for the current tax year

Flexible Saver

A simple and flexible savings account for you to save what you can, when you can.

Earn a better rate of interest on balances over £25,000

Get instant, easy access to your savings whenever you need them

Fixed Term Savings

Lock away your savings with our fixed term, fixed rate savings account.

Fix your savings pot on balances between £1 - £3,000,000

1 year terms - earn 3.30% / 3.25% AER/Gross p.a. (fixed) on balances between £1 - £99,999.

1 year terms - earn 3.40% / 3.35% AER/Gross p.a. (fixed) on balances between £100,000 - £3,000,000.

2 year terms - earn 3.30% / 3.25% AER/Gross p.a. (fixed) on balances between £1 - £99,999.

2 year terms - earn 3.40% / 3.35% AER/Gross p.a. (fixed) on balances between £100,000 - £3,000,000.

Interest is calculated daily and paid on the first business day of every month and on the Maturity Date.

Children's savings accounts

Invest in their future with our First Saver account

Access funds instantly, if you need them.

This account is to be opened by a parent/guardian in trust for a child who is under 16 years old.

Calculate and compare your potential savings

Calculate and compare your potential savings

Enter a few details and get an idea of what your balance could look like.

Our calculations are done with today's interest rates - these could change in the future. The projected balances below assume you won't withdraw any money.

Must have RBS current account? | |||||||||||

Eligibility | |||||||||||

Other interest rates | Must have RBS current account? | Eligibility | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Saving

Savings have the advantage of being dependable, predictable and easy to access. If you know you'll need a set amount of money in the next 12 months, for example, then regularly depositing in a savings account may be the best solution. Savings will grow over time as more money is put away, and any interest paid accrues on your balance.

Investing

If you are saving for a longer-term goal, typically five years or more, investing your money has the potential to grow your money and help protect your buying power from the effects of inflation.

The value of investments can go down as well as up, your capital is at risk. Eligibility criteria, fees and charges apply.

Tools to help monitor your savings

Our savings tools can help you to gain control over what’s coming in, what’s going out and how you could save more.

Manage your existing savings account

Your savings hub can help you find out about your interest rate and when you will be paid the interest you've earnt. Help your savings grow by using our tools and top tips. And you can learn about your personal savings allowance. Manage your account by clicking below and logging in.

Round Ups

Save your spare change with Round Ups. If you want to reach your savings goals even faster, try multiplying the spare change you save - multiply by 2, 3, 4 or 5 in your app.

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Royal Bank of Scotland are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

Find out more about the scheme and how it protects your money.