There's still time to open our Fixed Rate ISA using this year's £20,000 tax-free allowance. Deadline 5pm on 02 April.

Available until 5pm on 11 March 2026 to new customers and 16 March 2026 to existing customers. Please note that these issues may be withdrawn early due to limited availability. Early closure charges may apply.

Our Fixed Rate ISA

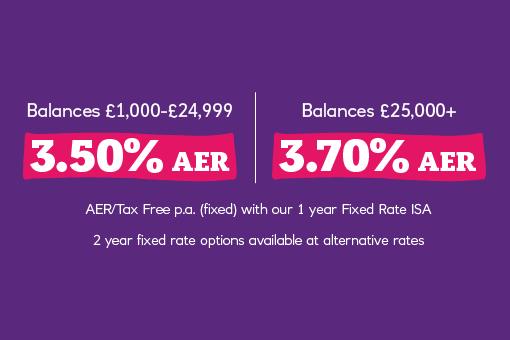

Earn 3.50% AER/Tax-free p.a. (fixed) on balances £1,000 - £24,999 or 3.70% AER/Tax-free p.a. (fixed) on balances £25,000+ when you fix for one year.

Earn 3.30% AER/Tax-free p.a. (fixed) on balances £1,000 - £24,999 or 3.50% AER/Tax-free p.a. (fixed) on balances £25,000+ when you fix for two years.

Interest is paid directly into your account and is tax-free, helping your savings grow faster.

Have complete certainty over what your savings will earn with a fixed rate of interest.

You can get our higher interest rate on balances of £25,000+ by moving ISA savings from a previous tax year using an ISA transfer.

Opening your Fixed Rate ISA

Whether you are a new or existing customer, you can still open a Fixed Rate ISA with us. T&Cs apply.

Opening a Fixed Rate ISA as a new customer

As you're a new customer, we'll need to check your ID before opening your account.

We'll do this by matching your photo ID to a selfie of you. You’ll need a device with a camera to upload these. We may also ask for other ID like proof of address. If you don’t have your ID to hand, you can finish this step later.

Key dates

11 March 2026 by 5pm

As a new customer, this is the last day you can apply and to make any external ISA transfers.

16 March 2026

It’s important we receive the requested information by this date. If we don’t, we’ll be unable to open your account. You'll still be able to apply for our next offer so check back with us on 17 March 2026.

Please ensure you read the summary box below before applying.

Already bank with us and want to open a Fixed Rate ISA?

If you already have a current account, credit card, loan or a savings account with us and want to open a Fixed Rate ISA, select apply to begin your application.

Please ensure you read the summary box below before applying.

What is the interest rate?

Key dates

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. Please take some time to review, print and/or save the important information.