You can add money to your account in four ways: Using your card in the NatWest Rooster Money app, by bank transfer from your bank account, through the Royal Bank of Scotland App and through digital banking

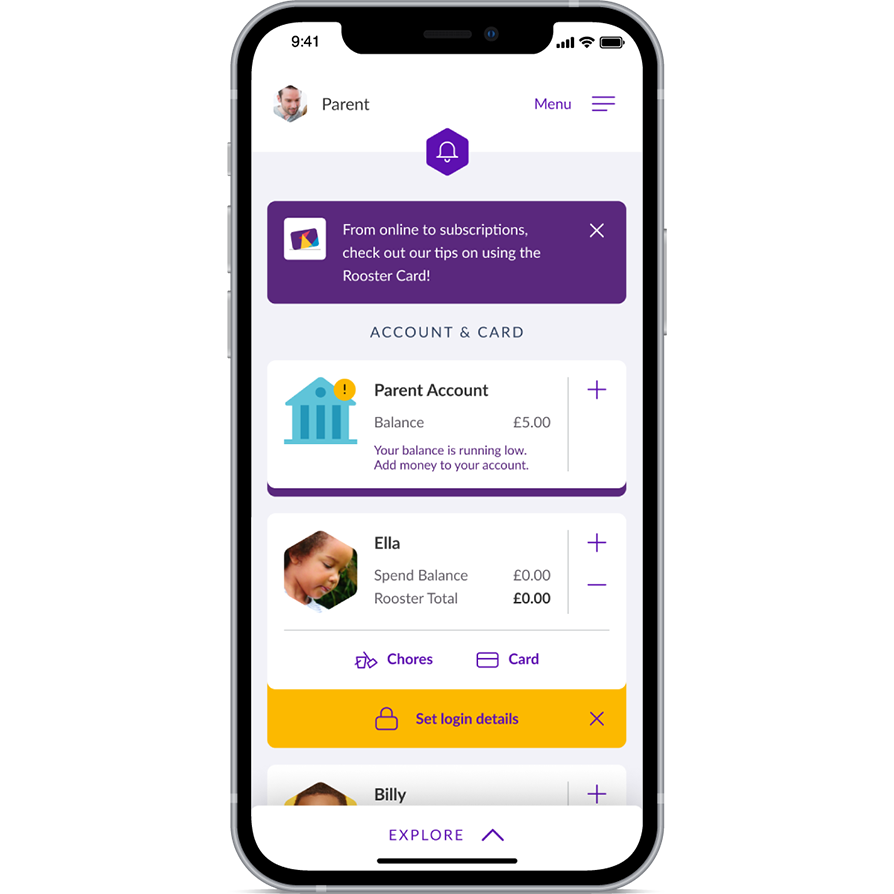

To add money using your card on the Rooster App:

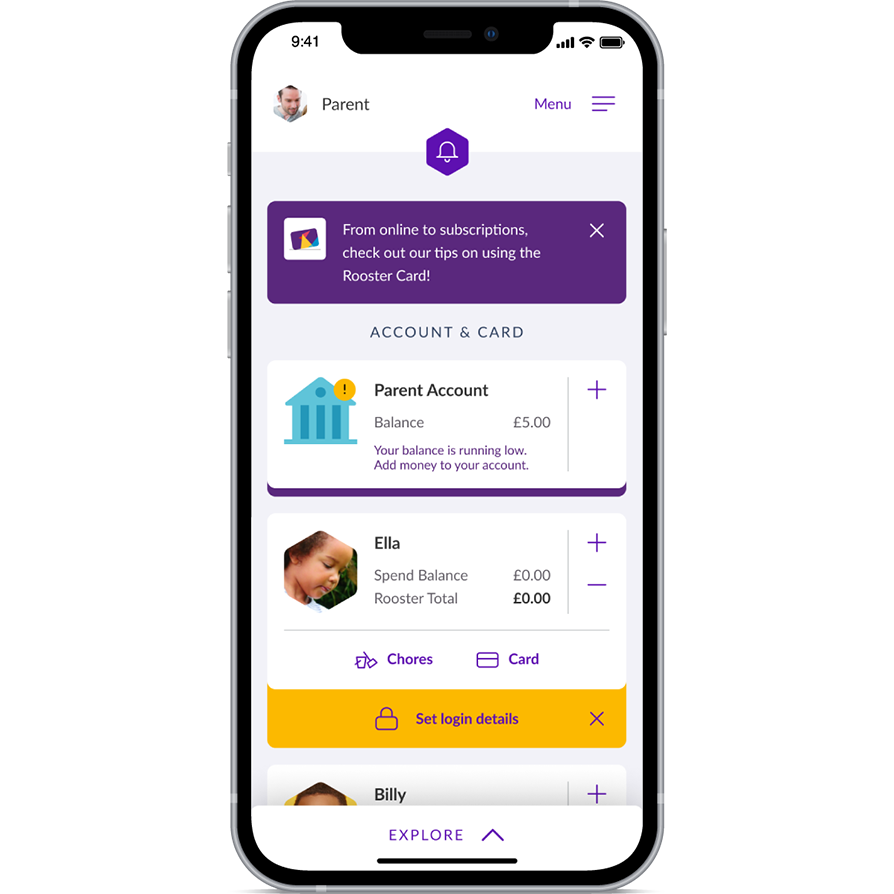

1. Tap the '+' next to the Parent Account.

2. Select 'Add using your debit card'.

3. Choose your amount (you can make payments up to £100 using your card).

4. Select the card you want to use for the top-up or select 'Add card' to add a new payment card. Enter the CVV for that card.

5. Tap the 'Top-up' button at the bottom.

To transfer money from your bank account:

1. Tap the '+' next to the Parent Account.

2. Select 'Add from your bank'.

3. You'll see your Account Number and Sort Code.

4. Head back to your own banking app to create a transfer to a new payee and enter your Rooster Account details.

5. Remember to select a business transfer rather than a personal transfer.

To add money through the mobile banking app:

1. Once you've connected your accounts, open up your mobile banking app.

2. Select the Rooster Money tile on your Royal Bank of Scotland App homepage.

3. Tap ‘Top-Up’ and follow the simplified payment journey to top up either the parent account or child card.

To add money through digital banking:

1. Once you've connected your accounts, log in to your digital banking account.

2. Select the Rooster Money tile.

3. Click ‘Top-Up account’ and follow the simplified payment journey to top up either the parent account or child card.