Our survey of 5,001 students looks at typical university costs and the most affordable cities.

Understanding student living costs in 2025

Discover the ins and outs of university life with the Student Living Index from Royal Bank of Scotland.

After a decade of student insights, our survey has asked 37,776 people about their experiences of university since 2015.

The 2025 edition shows the most affordable student cities in the UK. We also explore the expenses students commonly face, and how they budget for them.

Our survey of 5,001 UK undergraduates was conducted between 22nd April and 20th May 2025 by Savanta.

Key findings

- The cheapest regional student rent is now found in the North of England, where people pay a monthly average of £530.27.

- Many students are balancing their budgets with multiple sources of income. For example, with help from side-hustles and influencer marketing.

- Students typically spend £30.83 on a night out. But one in five never go to the pub.

- University resources, family support and personal coping mechanisms are helping with financial stress.

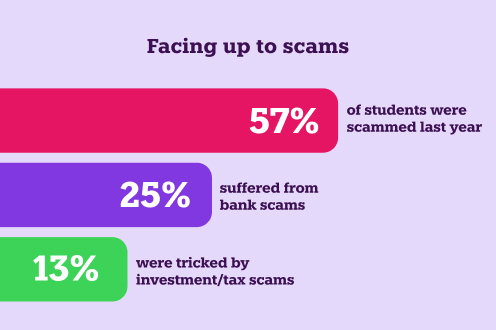

- Fraud attempts and scams have targeted 57% of undergraduates, rising from 30% in 2024.

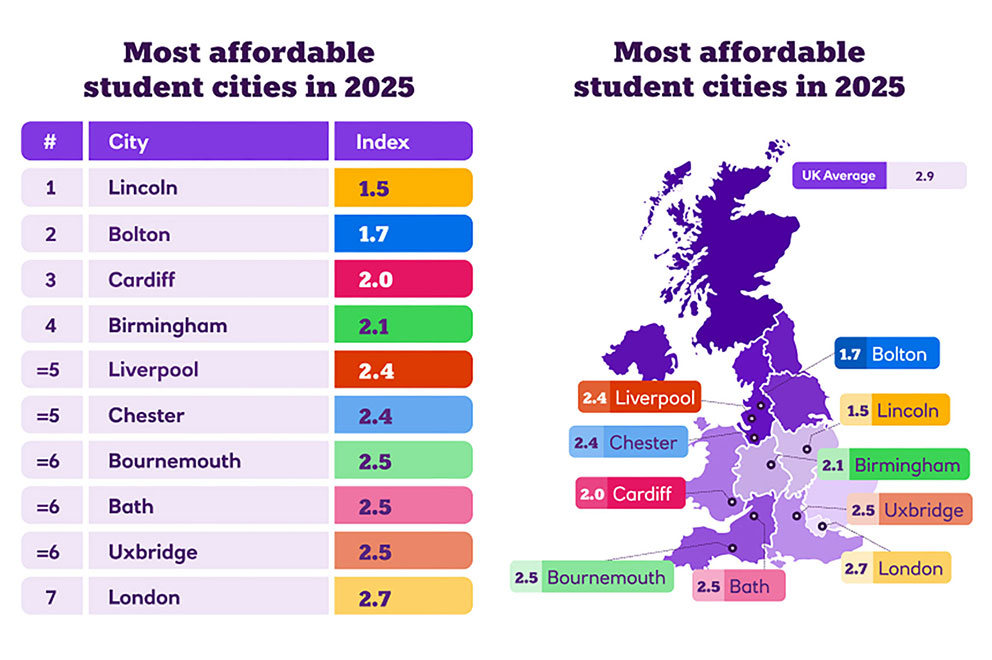

Which UK city is most affordable* for students?

Lincoln, Bolton and Cardiff are now the most affordable student towns and cities. Here’s a breakdown of the top 10 this year.

* Our Index aims to understand the financial situation of students by comparing their average monthly expenses (accommodation, activities, and essential items) with their average monthly income. A score of 1.0 would mean student expenses match income perfectly, while a score above 1.0 shows that expenses exceed income. It's important to note that this Index focuses on income but excludes student loans. Therefore, the Index provides a view of earned income versus expenses.

Everyday expenses and income

Across the UK, students pay £562.67 in average rent each month. Groceries (£146.76), household bills (£124.08), and clothing, shoes and accessories (£123.30) are their next biggest monthly costs.

Eating out and takeaways (40%), alcohol (32%), and items of clothing (22%) were named as their biggest spending regrets.

Parental support (49%) and student loans (48%) are the top ways for undergraduates to cover their rent. Personal income (41%) and savings (19%) are other common methods.

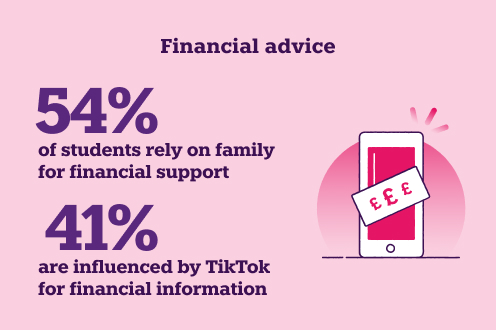

When it comes to financial advice, family remains the top source, with 54% of students turning to their relatives.

TikTok is now a source of advice for 41% of students, as social media plays a growing role in society.

Money management

One in three (33%) students are confident about money management. However, financial difficulties and pressures have encouraged a third to consider dropping out. Meanwhile, 53% say they run out of money before their term finishes.

Gap years remain a popular option before university, with 29% of students going on one. Around half (46%) saved money towards their studies while on their gap year.

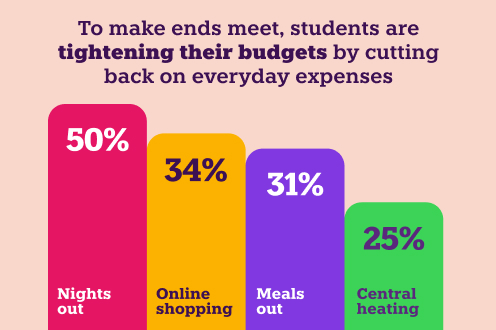

Half of university goers are trying to budget by cutting down on their nights out.

Fraud and scams

Fraud and scam attempts have risen since our last annual survey. Over the past year, more than half (57%) of students have had to contend with these threats. In 2024, this figure was only 30%.

Bank scams are the most common risk for students this time around, climbing to 25% from just 9%. And students typically lose £287.60 when they fall victim to fraud and scam activities.

Need a Student bank account?

Our Student bank account offers lots of features:

- £85 and a four-year tastecard. Offer T&Cs apply.

- Up to £2,000 interest-free arranged overdraft from year one (limited to £500 in your first term).

- Apply for up to £3,250 interest-free from year three onwards.

Overdraft subject to our lending criteria; 18+.

- To apply, you must be 17+ and have been living in the UK for at least 3 years. Online applications only.

- To confirm you're a student and eligible for this account, we require your unique 16 digit UCAS code. Courses without a UCAS code are not eligible for our student account.

- You need to be a full time undergraduate student (on at least a 2-year course at a UK university/college) or nursing course lasting a year or more. You can apply within 6 months of your course start date.

- You must use your student account as your main account by depositing student finance, wages, or other regular income into it.

More help and support for students

Browse our student guides and resources to learn more about university life and money management.