Switch a bank account to our Select account and you could get our Switch & Save offer. Offer T&Cs and restrictions apply.

Limited Edition Saver interest rates

AER / Gross p.a. (variable)

Interest paid monthly

4.00% / 3.93%

Balances between £100k - £3m

(includes 2.25% / 2.23% AER / Gross p.a. (fixed) 12 month bonus).

3.25% / 3.20%

Balances between £50k - £99,999

(includes 1.50% / 1.49% AER / Gross p.a. (fixed) 12 month bonus).

1.06% / 1.05%

Balances up to £49,999

2. Switch complete

Wait to receive the offer email from us

Once your switch to us is complete, we'll send you an email with a link to open a Limited Edition Saver account. This will arrive between 02 December and 21 January 2026.

You'll have until 23 January 2026 to apply for a Limited Edition Saver via our mobile app.

3. You're all set

Fund your account

Once you've opened your Limited Edition Saver and funded your account, you'll immediately start benefiting from the interest rates.

Step 1

We'll send a request to your old bank to confirm the switch and we'll keep you updated every step of the way.

Step 2

Your old account will be closed on your behalf. Your balance and payments (like Direct Debits) will be moved to your Royal Bank account.

Step 3

The switch is complete. Once you've met our switch offer eligibility criteria, you'll get an email to open your Limited Edition Saver account. This will arrive between 02 December 2025 and 21 January 2026.

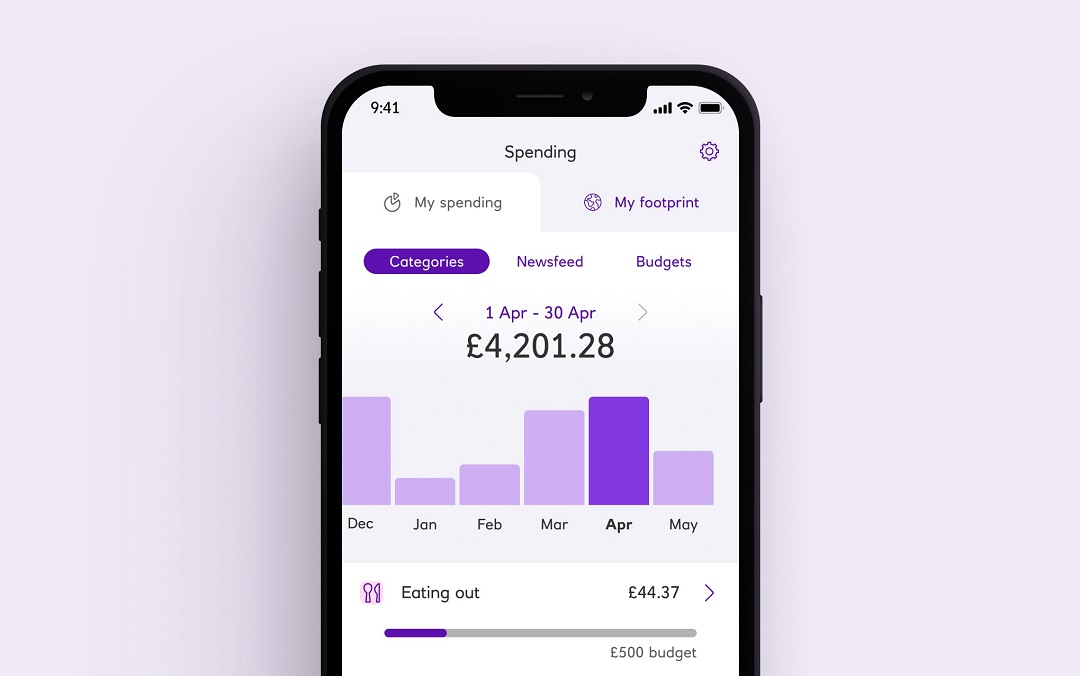

Mobile banking screen showing budgeting activity

Mobile banking screen showing budgeting activity Budget better, spend less

Spending will put your transactions in to categories, giving you a detailed view of where your money is going.

Available to customers aged 16+ who hold a Personal or Premier current account.

Mobile banking screen for viewing Credit Score

Mobile banking screen for viewing Credit Score Know your score

With our mobile app you can keep up to date with your credit score for free.

Available to customers aged 18+, with a UK address and is provided by TransUnion.

Mobile banking screen for Open Banking

Mobile banking screen for Open Banking View your accounts with other banks

View balances and transactions on selected accounts with participating UK banks. All your money on one screen.

You need to be registered for online banking with your other banks.

How to open a bank account online

Everyday current account – Frequently asked questions

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Digital Banking - not posted. Please take some time to review, print and/or save the important information.

Get a financial health check

Review your finances with our free financial health check. Fill in a few details and get useful hints and tips.

Learn how to manage your money

It can be tricky to know where to begin when it comes to saving money. But our quick guide can help point you in the right direction.

Get better at budgeting

Setting yourself budgets is a brilliant way to get your spending under control. In a few simple steps you could be saving money in no time.