You can look after your mortgage online whenever it suits you. Just log in and you’ll see everything in one place.

Overlay

Manage your mortgage with confidence

Manage your mortgage online — see your balance, make extra payments, check your home’s value, explore new deals and more!

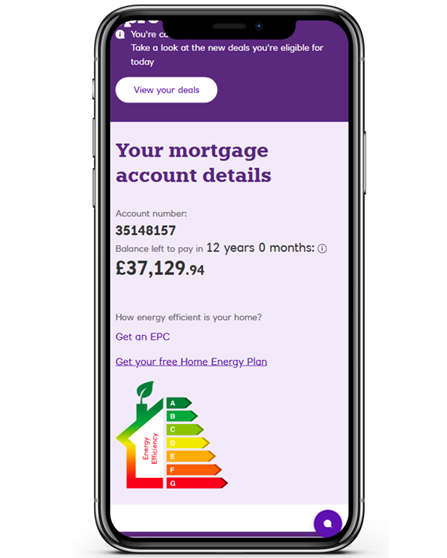

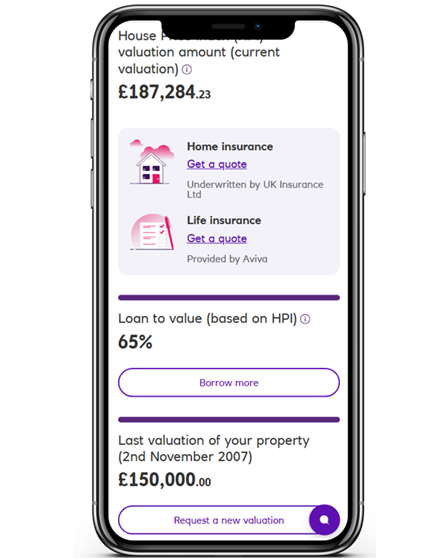

View your mortgage details, balance and see if you can switch your deal

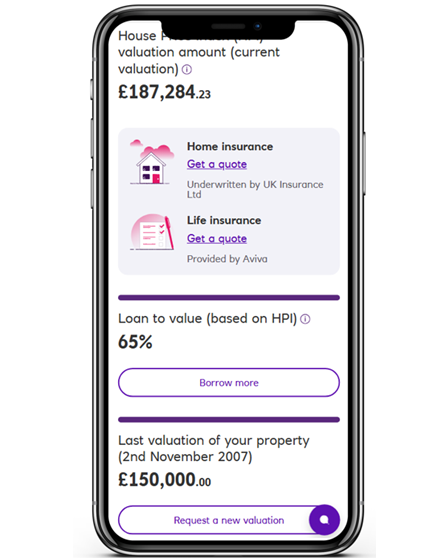

Find out your home value, your loan to value or get a quote for insurance

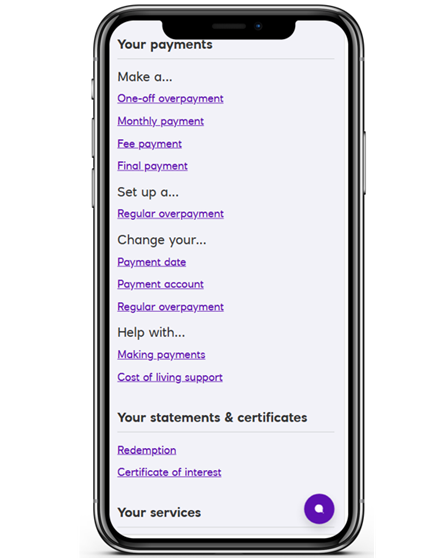

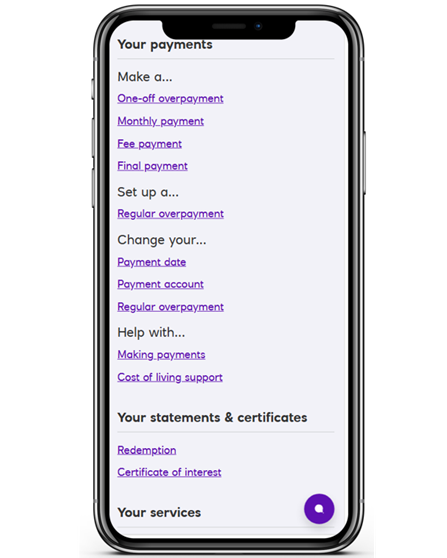

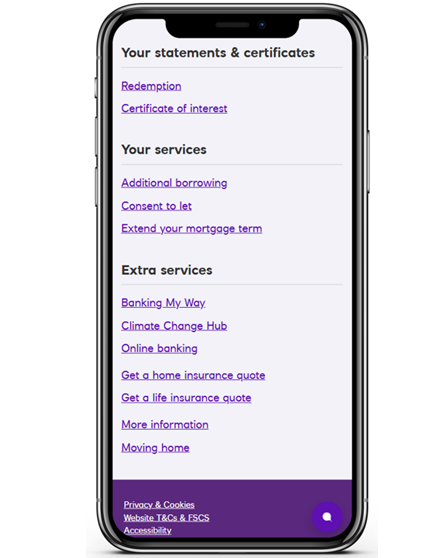

Make overpayments, change your payment dates or payment account

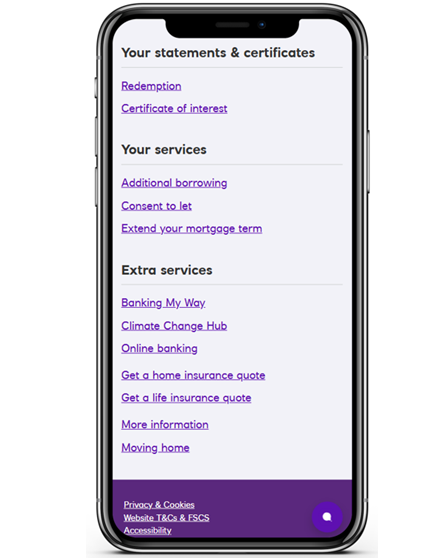

Apply to borrow more, get consent to let or extend your mortgage term

Manage your mortgage with confidence

Manage your mortgage online — see your balance, make extra payments, check your home’s value, explore new deals and more!

Get the Royal Bank app

- Open the App Store (iPhone) or Google Play (Android).

- Search for “Royal Bank of Scotland.”

- Download the app.

If you need help registering, we can guide you.

Information Message

Log in to the Royal Bank App

- Open the app.

- Choose your mortgage account.

- Tap “Manage my Mortgage”

Information Message

Log on to Digital Banking

Once you’ve logged in, look for the ‘Manage your Mortgage’ section to get started.

Not signed up yet?

Information Message

Only have a mortgage with Royal Bank?

If we ask for an account number, enter your mortgage account number.

When you register, we’ll create a customer number for you. Please keep this safe.

If you need help, our step‑by‑step guide will walk you through the process.