A joint mortgage where only one person owns the property.

What is a Royal Bank Family-Backed Mortgage

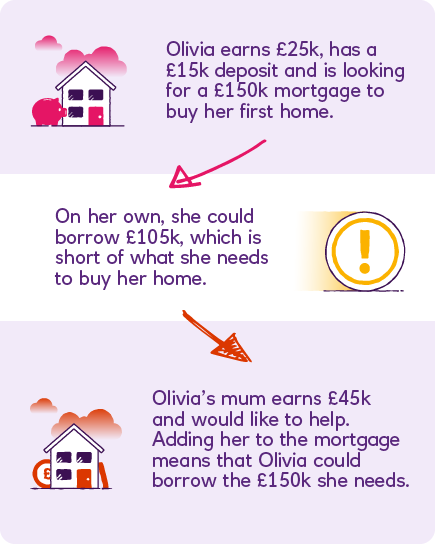

A Royal Bank Family-Backed Mortgage, sometimes known as a ‘joint borrower sole proprietor’ (JBSP) mortgage, can help buyers get onto the property ladder sooner or borrow more. It lets you add a second person to your mortgage but without them owning the property.

Adding a second person to your mortgage as a 'non-owner', can help you borrow more than you would otherwise have been able to borrow, which means you could buy your own home sooner than you thought. And, the non-owner could be a family member or friend.

We can’t give any advice or recommendations about who the applicants for a mortgage should be. When applying, you’ll need to say who should be named on the mortgage.

Benefits

You could get on the property ladder sooner with help from a family member or friend.

The additional income of a second applicant, could provide you with greater borrowing potential.

The owner occupier would have full ownership rights to the property, whilst the non-owner, would have no ownership rights.

Considerations

- Both the owner occupier and non-owner are liable for the mortgage. The non-owner will need independent legal advice and this will be an extra cost.

- The mortgage criteria needs to be met by both applicants. This means the mortgage term could be restricted because we may not be able to lend past an intended retirement age.

- Royal Bank Family-Backed Mortgages are not available with the Shared Equity or Right to Buy schemes.

- Landing

- About us

- Expenses

- Deposit

How much could you borrow with a Family-Backed Mortgage?

With a family member or a friend as the non-owner, you could borrow more with a Royal Bank Family-Backed Mortgage. Get a quick quote using our mortgage calculator.

Find out in less than 5 minutes

Great, now tell us a bit about you

You’ll need to tell us who’s applying, your pre-tax annual income, and if you have any dependants.

Next, tell us about your expenses?

We’ll need this information to understand how much you could afford for a mortgage.

Finally, we just need these last few details

Let us know how much deposit you have and how long you'd like to pay the mortgage over.

The need for independent legal advice

The non-owner on a Royal Bank Family-Backed Mortgage will be just as liable for the mortgage payments as the owner-occupier.

To make sure that the non-owner fully understands their responsibilities and the expectations on them, they’ll need to get independent legal advice from a solicitor that is separate to the regular conveyancer needed when buying a new home.

As a non-owner, they'll need to get a letter from their chosen solicitor proving they've been given legal advice about the Family-Backed Mortgage.

The Law Society of Scotland register must be used to confirm that the solicitor or firm is regulated.

Non-owner fact sheet

Review the following document to find out more if you are planning to be a non-owner on a Royal Bank Family-Backed Mortgage.

Here to help you buy your first home

Step 1: Get an Agreement in Principle

- Get a personalised indication of how much you could borrow in less than 10 minutes.

- It won't impact your credit score.

Step 2: Ready to apply for your new mortgage?

- Apply online today or contact us if you'd like support.

- Save progress and come back whenever you like.

Explore our home-buying mortgage guides

Need some help or want to speak to a mortgage professional?

Call us

We're on hand to arrange a phone or video call with one of our qualified mortgage professionals. We can also help with any general queries about the process.

Call us on ${dn-0800 056 0567}

Relay UK: 18001 0800 056 0567

Opening hours: Mon-Fri 8am-6pm, Sat 9am-4pm, Sun Closed. Excluding public holidays.