Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

We want to make your financial life as simple as possible, so we’ve gathered all the information for your Select account in one place.

Pay with your debit card and we'll round up the amount to the nearest pound, then send the spare change to your savings account.

Save little and often and the pennies soon add up. Eligibility criteria and limits apply.

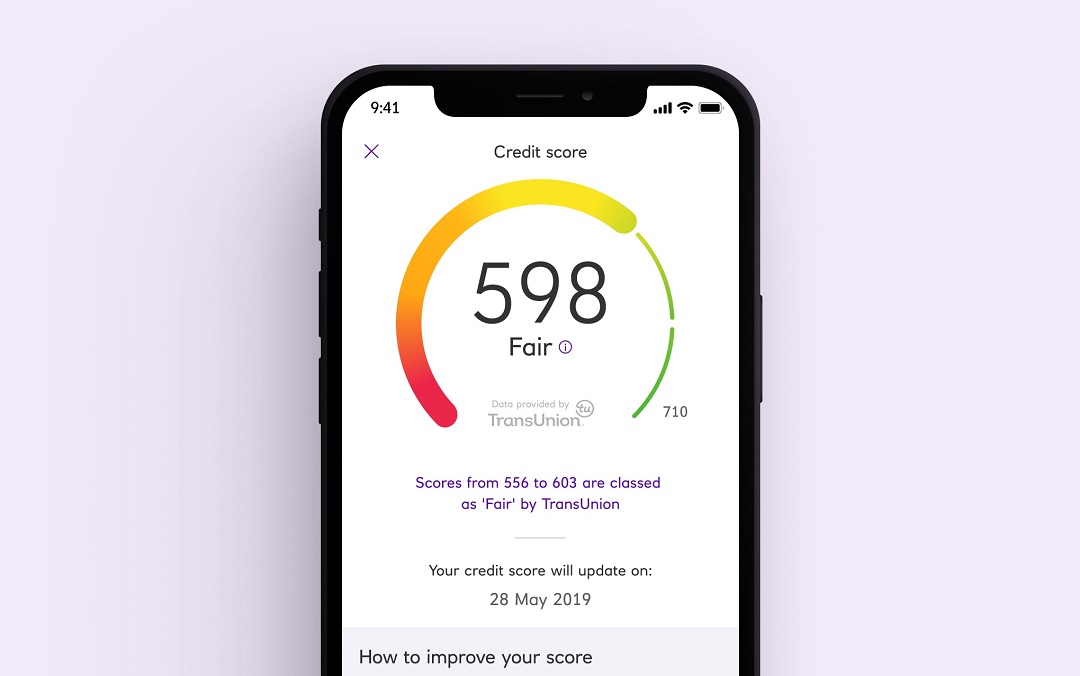

Get on top of your finances by regularly monitoring your credit score in our app.

Available once opted in through the app to customers aged 18+ with a UK address and is provided by TransUnion.

Withdraw up to £130 every 24 hours from our branded ATMs. You must have at least £10 available in your account and an active debit card.

Simply log in to your app and tap the “Get Cash” icon - you’ll find it at the bottom of the app home screen.

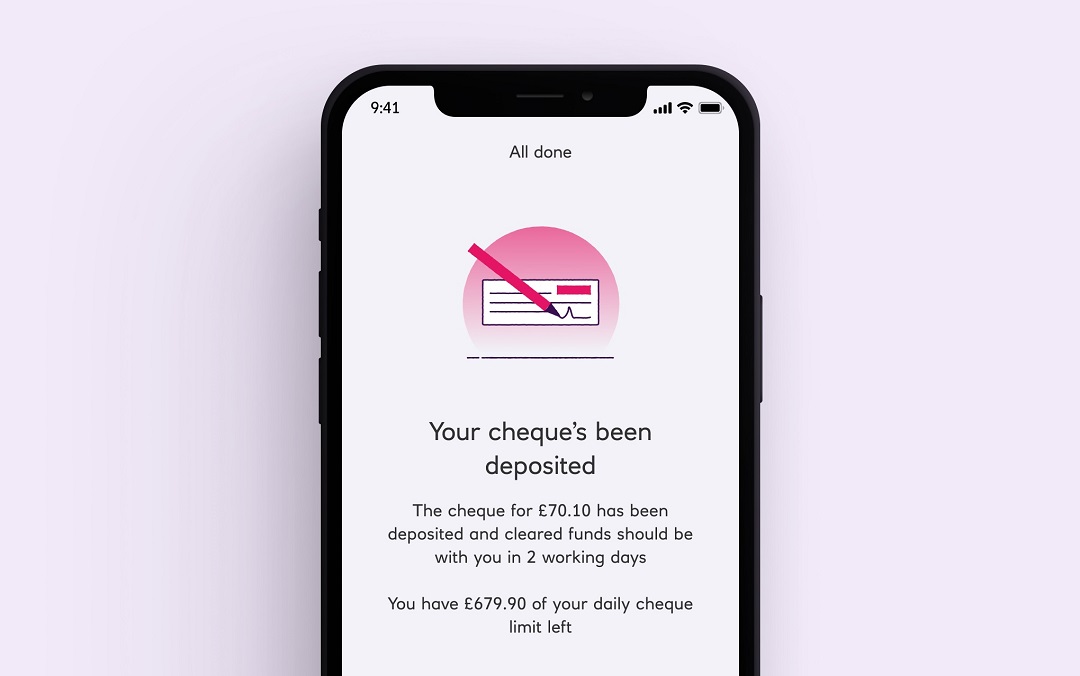

You can now pay in your cheques anytime, anywhere. Just take a photo of the front and back of the cheque using our app and the money will be paid into your account. It's simple, secure and saves you a trip to the branch.

Limits apply.

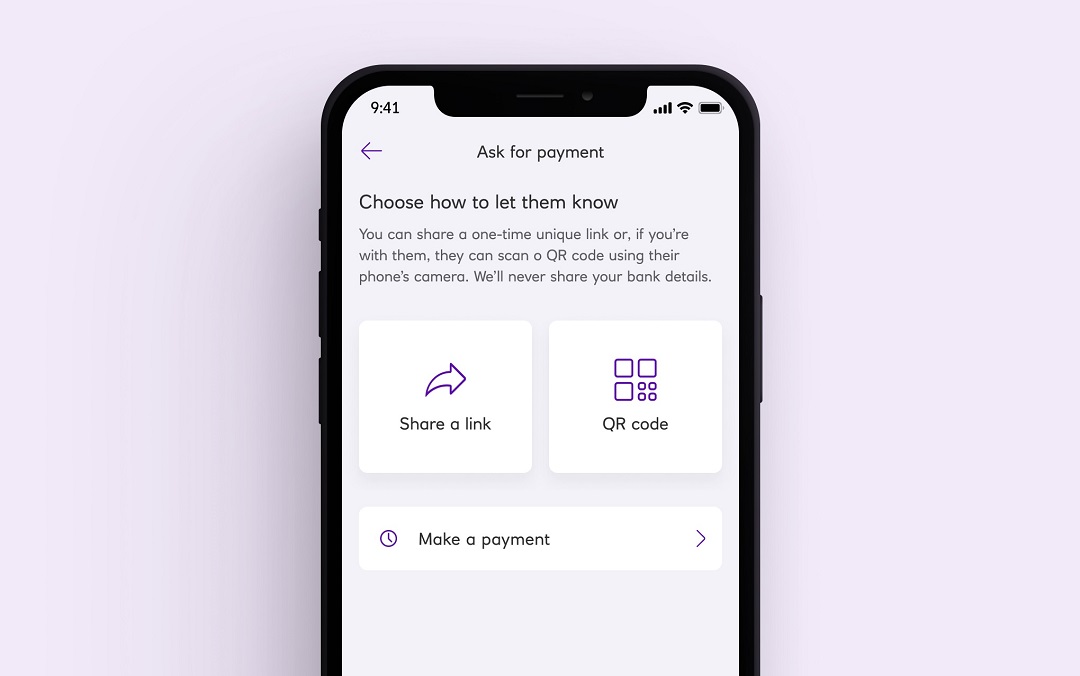

You can now request money from within the mobile app without sharing your account details.

“PayMe – Ask for Payment” allows you to request money from almost anyone with a UK bank account. Eligibility criteria and limits apply.

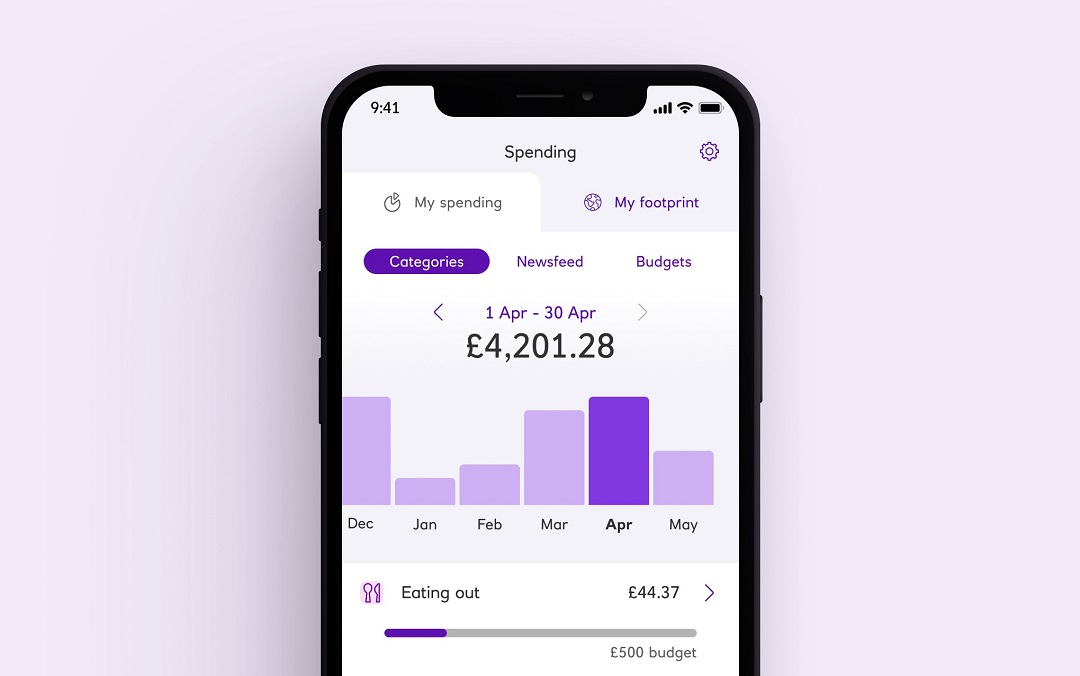

Put your spending into categories and get a detailed view of where your money is going.

You must be aged 16+. Only available for Personal and Premier accounts.

Our app is available to personal and business banking customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.

It's quick and easy to change your current account through your Royal Bank mobile app or Digital Banking, we'll even pre-fill the application for you.

We have a range of accounts to choose from. The Select account could be ideal if you want to keep things simple, or check out our Reward bank accounts if you're interested in receiving extra benefits and rewards.

Specific account eligibility criteria and monthly fee may apply.

The Current Account Switch Service will do all the work when it comes to switching, moving everything across from your old account all within 7 working days, including Direct Debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the Switch to start.

We can not switch savings accounts or ISAs through this service. Any other products you have with your old bank will not be moved at the same time.

Current Account Switch Guarantee (PDF, 39KB)