Take advantage of our fixed bonus interest on balances between £50,000 - £3,000,000 with no withdrawal restrictions when you switch your current account to Royal Bank. Eligibility criteria and T&Cs apply.

Limited Edition Saver

An account that rewards bigger savings

Switch & Save with Royal Bank and benefit from a 12 month fixed bonus on balances between £50,000 and £3,000,000 with full access to your funds anytime.

- Instant access so you can take money out whenever you need to, with no early withdrawal charges.

- Interest paid monthly.

- 12 month term.

Interest rates

AER / Gross p.a. (variable)

4.00% / 3.93%

Balances between £100k - £3m (includes 2.25% / 2.23% (fixed) 12 month bonus)

3.25% / 3.20%

Balances between £50k - £99,999 (includes 1.50% / 1.49% (fixed) 12 month bonus)

1.06% / 1.05%

Balances up to £49,999

Limited Edition Saver

An account that rewards bigger savings

Switch & Save with Royal Bank and benefit from a 12 month fixed bonus on balances between £50,000 and £3,000,000 with full access to your funds anytime.

- Instant access so you can take money out whenever you need to, with no early withdrawal charges.

- Interest paid monthly.

- 12 month term.

Interest rates

AER / Gross p.a. (variable)

4.00% / 3.93%

Balances between £100k - £3m (includes 2.25% / 2.23% (fixed) 12 month bonus)

3.25% / 3.20%

Balances between £50k - £99,999 (includes 1.50% / 1.49% (fixed) 12 month bonus)

1.06% / 1.05%

Balances up to £49,999

Interest is calculated daily and paid on the first business day of the month and at account closure. You’ll be able to see and access the interest in your account on the following day. During the 12 month term, if you have a balance of £50,000 and £3,000,000, you will earn the bonus interest rate in addition to the variable rate. If your balance drops below £50,000 at any time during the 12 month term, interest will be paid at the variable interest rate on a tiered basis. This means you’ll earn one rate on your entire account balance. The tiers are set out above. Interest is earned from the first payment made to the account.

2. Switch complete

Wait to receive the offer email from us

Once your switch to us is complete, we'll send you an email with a link to open a Limited Edition Saver account. This will arrive between 02 December 2025 and 21 January 2026.

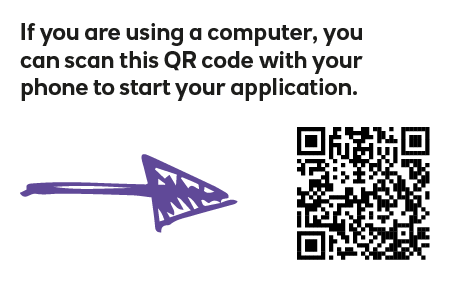

You'll have until 23 January 2026 to apply for a Limited Edition Saver via our mobile app.

3. You're all set

Fund your account

Once you've opened your Limited Edition Saver and funded your account, you'll immediately start benefiting from the interest rates.