As an administrator, you play a crucial role in how your business uses Bankline.

You’ll have responsibility for:

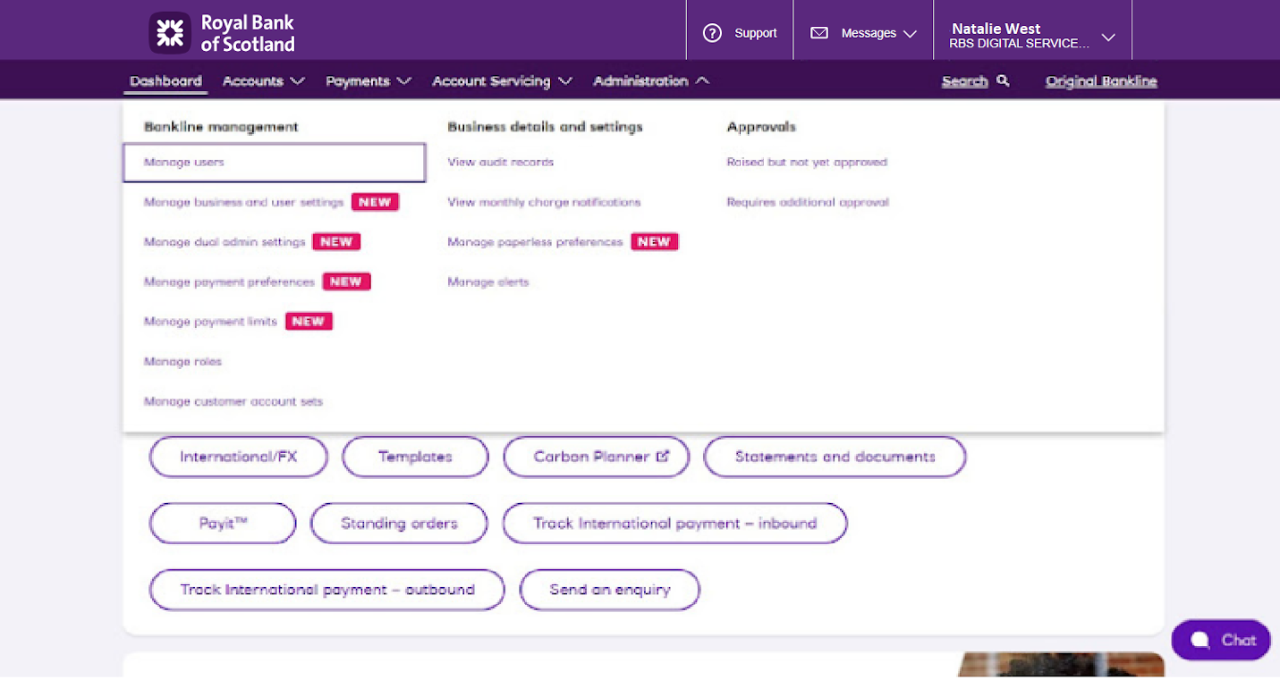

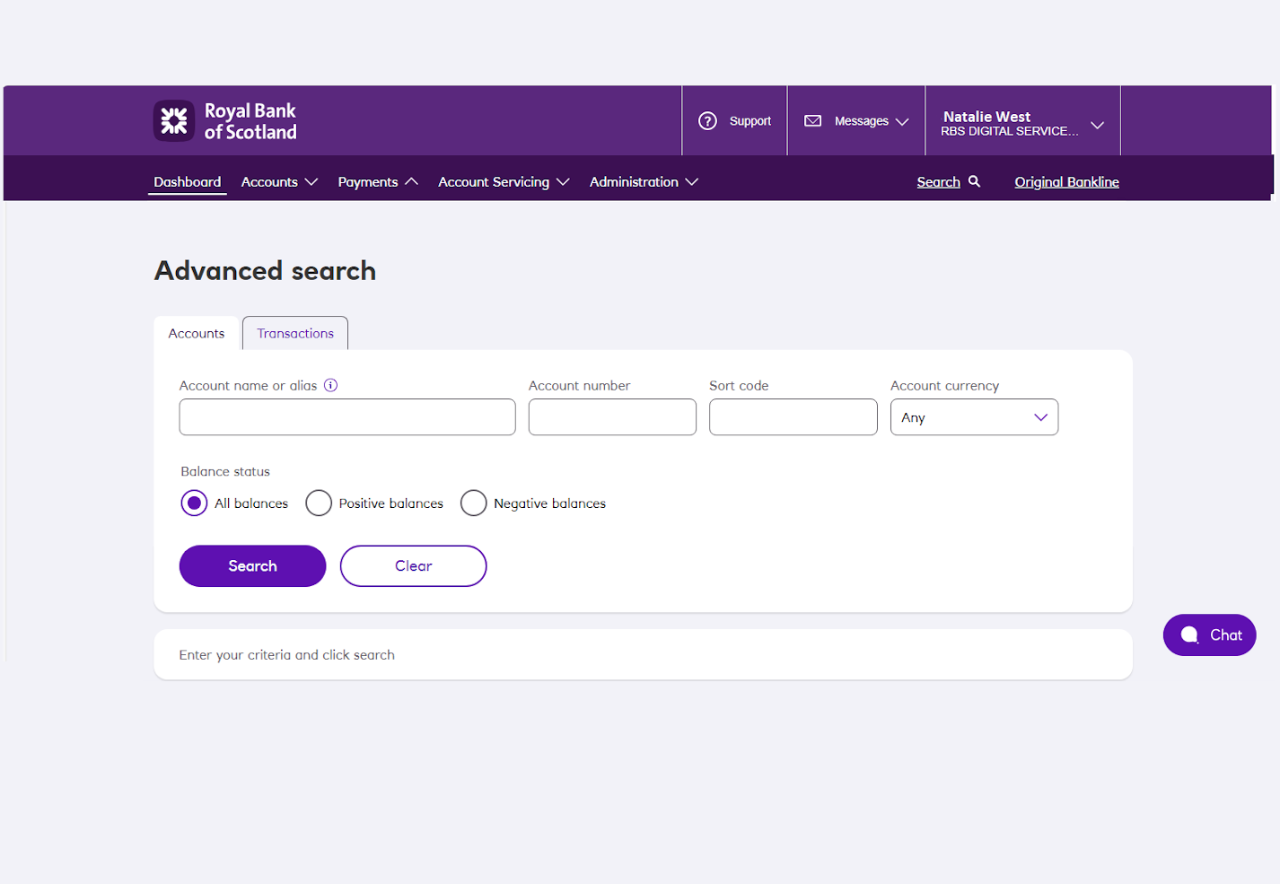

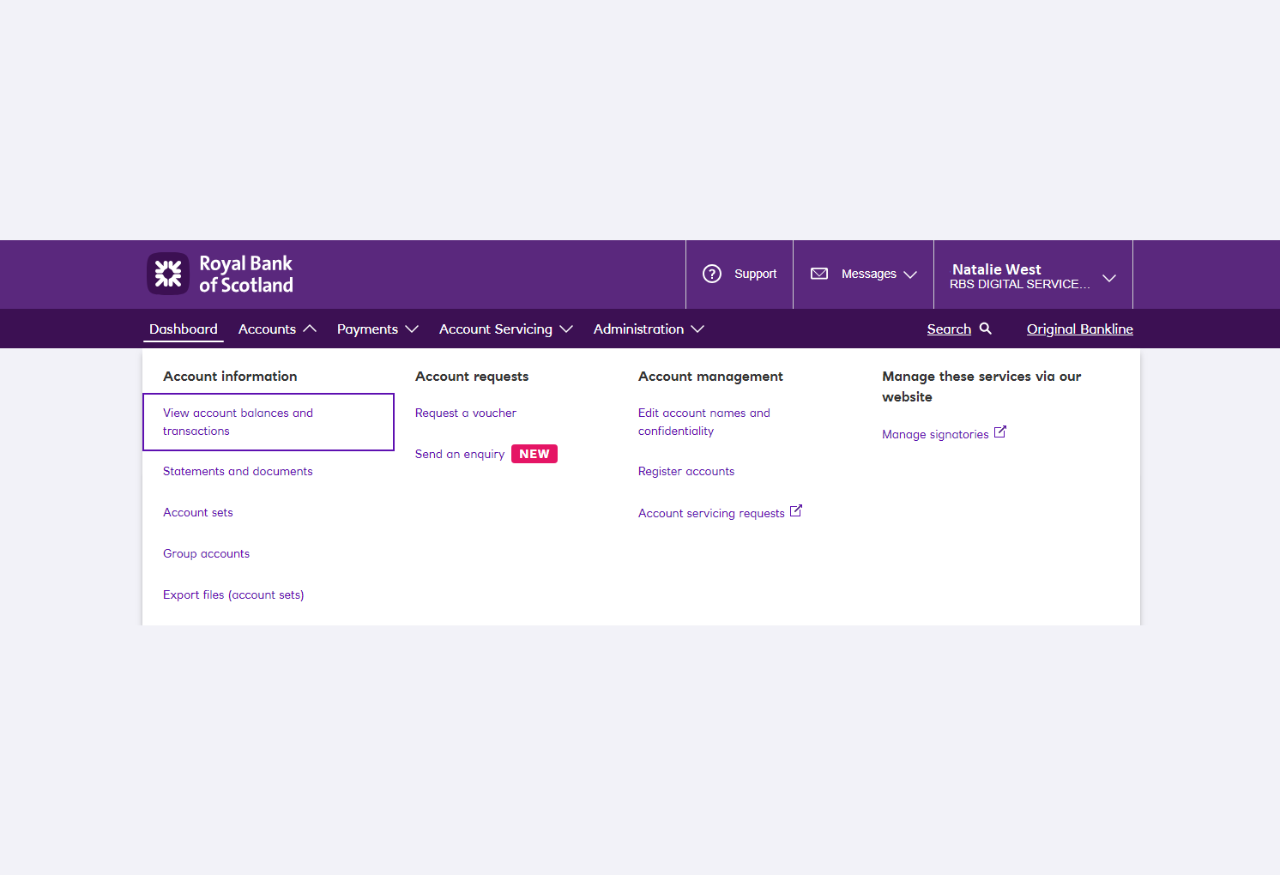

- Adding accounts and setting payment controls.

- Creating new users and setting what they can do.

- Supporting your users with day-to-day things like system access.

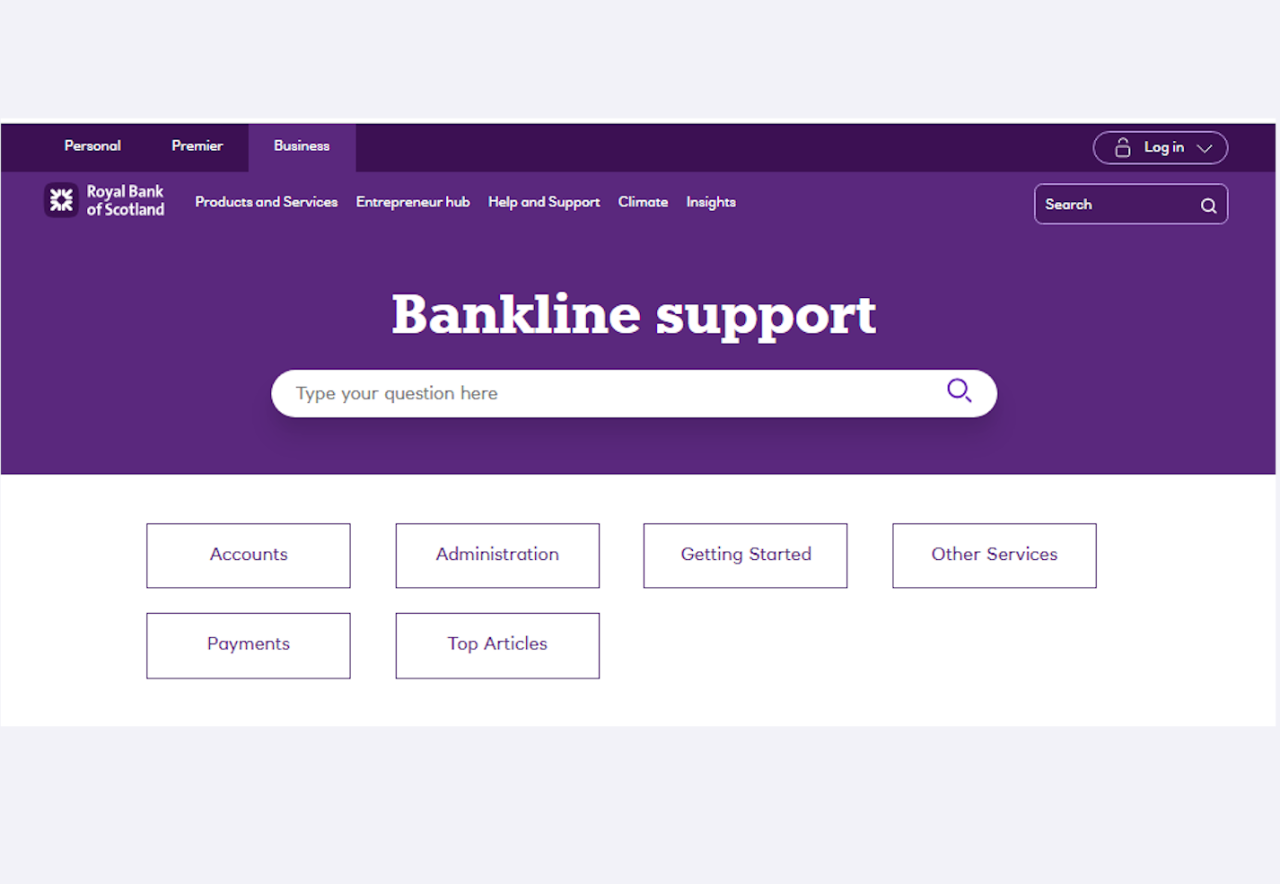

- Helping your team get the best from Bankline.

Tip: No need to go it alone. You can create more administrators to share the responsibility– especially useful for holiday cover.

Set your organisation up well and you’ll be saving time, syncing Bankline with your business processes and running your finances securely. Plus, you’ll be a Bankline pro in no time, with transferable expertise in digital finances and system management.

Here’s what you’ll need to do in that crucial first week before you log in.