Security, guarantees or indemnities may be required. Product fees may apply. Finance subject to status and is only available for business purposes except where specifically indicated to the contrary. Any property or asset used as security may be repossessed or forfeited if you do not keep up repayments on any debt secured on it.

Hire Purchase

Hire Purchase could give you the financing you need to own a vehicle or other asset.

Contract Hire

Contract Hire could give you the flexibility of leasing a car or a van.

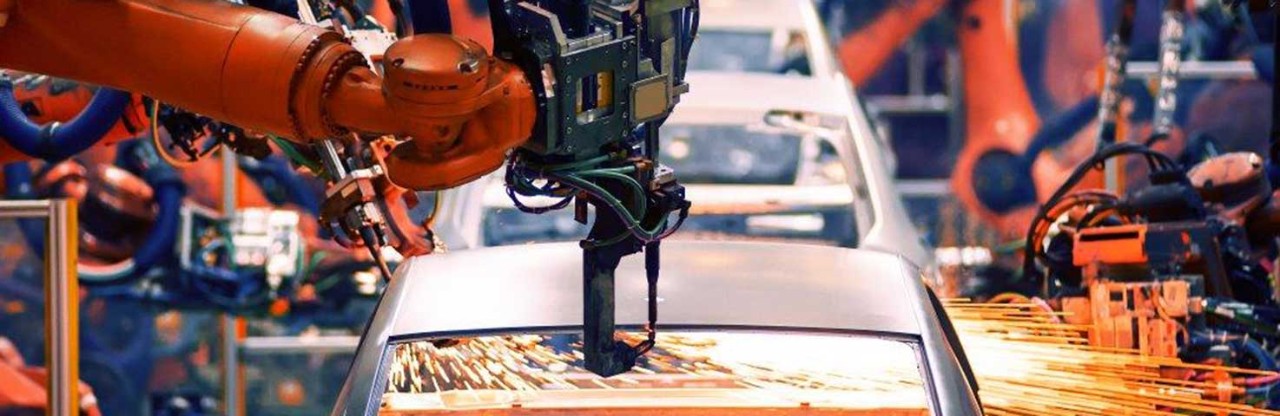

Specialist assets

We have a range of finance solutions to help fund and manage your specialist assets.

Fixed rate

- Applicable to Hire Purchase and Conditional Sale agreements

- The interest rate stays the same throughout the agreement, so you always know how much you’ll pay back

- The stability of a fixed rate could make it easier to manage your cash flow and business costs

- You may pay additional charges for settling early

- You can apply online

Variable rate

- Applicable to Hire Purchase agreements only

- The interest rate may vary as it changes in line with the Bank of England Base Rate

- As a more flexible option, your monthly repayments may go up and down

- You won't pay additional charges for settling early

- Contact us to obtain a quote

Audi A3 5DR Sportback 40 eTFSI 204 Sport S-tronic

With advance payment of £2709.72 excl. VAT

Based on a 48 month contract for 5,000 miles per annum, excluding maintenance.

Expiry date: 02/03/2026

Tesla Model 3 Saloon Standard Auto RWD

With an advance payment of £3170.90 excl. VAT

Based on a 48 month contract for 5,000 miles per annum, excluding maintenance.

Expiry date: 03/03/2026

Peugeot Boxer Van 335 L2H1 2.2 Blue HDi 140 Professional Start Stop

With an advance payment of £3529.44 excl. VAT

Based on a 48 month contract for 5,000 miles per annum, excluding maintenance.

Expiry date: 05/03/2026

Still looking for the perfect vehicle?

By clicking on 'View full offer details' you are confirming that you agree to be transferred to an intranet site provided by LVS and operated by ALD Automotive LTD. For full details on the relationship between Lombard and LVS click here.

Lombard Vehicle Solutions (LVS) is a product provided for Lombard North Central plc (Lombard) by ALD Automotive Ltd (ALD), trading as Lombard Vehicle Solutions, Oakwood Drive, Emersons Green, Bristol, BS16 7LB. ALD is authorised and regulated by the Financial Conduct Authority, registered no. 308101.

For LVS activities Lombard is acting as a Credit Broker and not a Lender. Lombard is authorised and regulated by the Financial Conduct Authority for consumer credit activities, registered no. 710598. Lombard will receive a commission or other payment from ALD should you wish to proceed with an agreement. You can ask Lombard or LVS about this.