Get ready for Bankline

Know what you need to get started

Here’s what you’ll need to log in to Bankline for the first time:

- Your activation code: You’ll have this already in the email we sent you.

- Your Customer ID and User ID: Log in details to enter every time you log in. Your administrator will give you these.

- Your smartcard and card reader: Your administrator may give you these, or they may be sent to your home or office address.

- Smartcard PIN: The code to activate your smartcard. We’ll post this to the address registered for you in Bankline.

For UK addresses, it takes 7 days for your smartcard and reader to arrive from the point your administrator set you up.

Check out our commonly asked log in questions:

1. Talk to your administrator

Your administrator will be reaching out to share your Customer ID and User ID. Why not take the chance to have a quick chat about Bankline?

They’ll know how your organisation uses Bankline and have plenty of advice to share.

Ask them about:

- What role you’ll have and what you’ll be doing in Bankline.

- The security controls that your organisation has in place in Bankline.

- Whether you’ll be needing the Bankline Mobile app.

- If there are any other administrators (good to know for future reference).

2. Take a quick tour

Check out this short video for an introduction to Bankline and its key features.

To get a feel for how Bankline works, take a look at the dashboard below and explore the key areas of Bankline. Permissions are required to access some of these areas.

Choose an area to learn more:

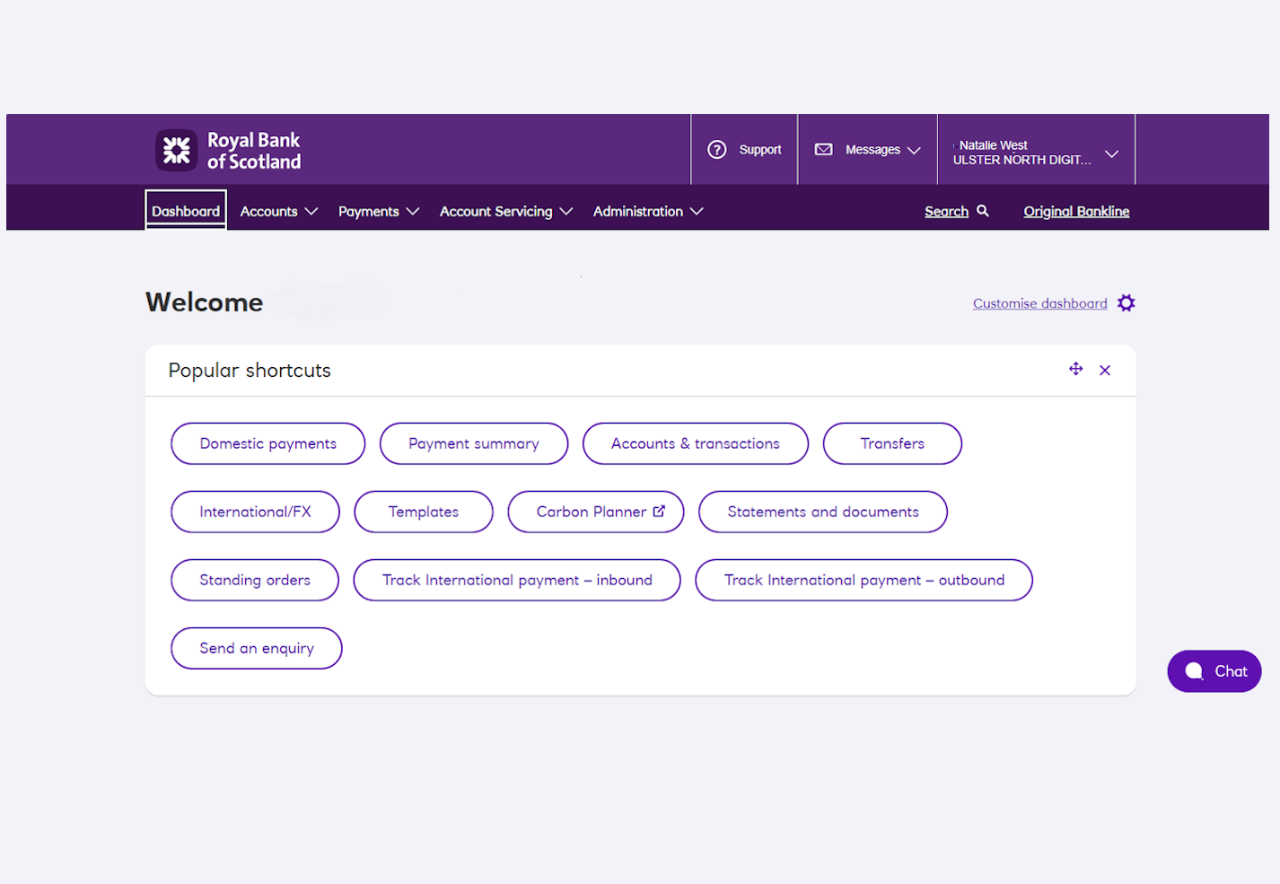

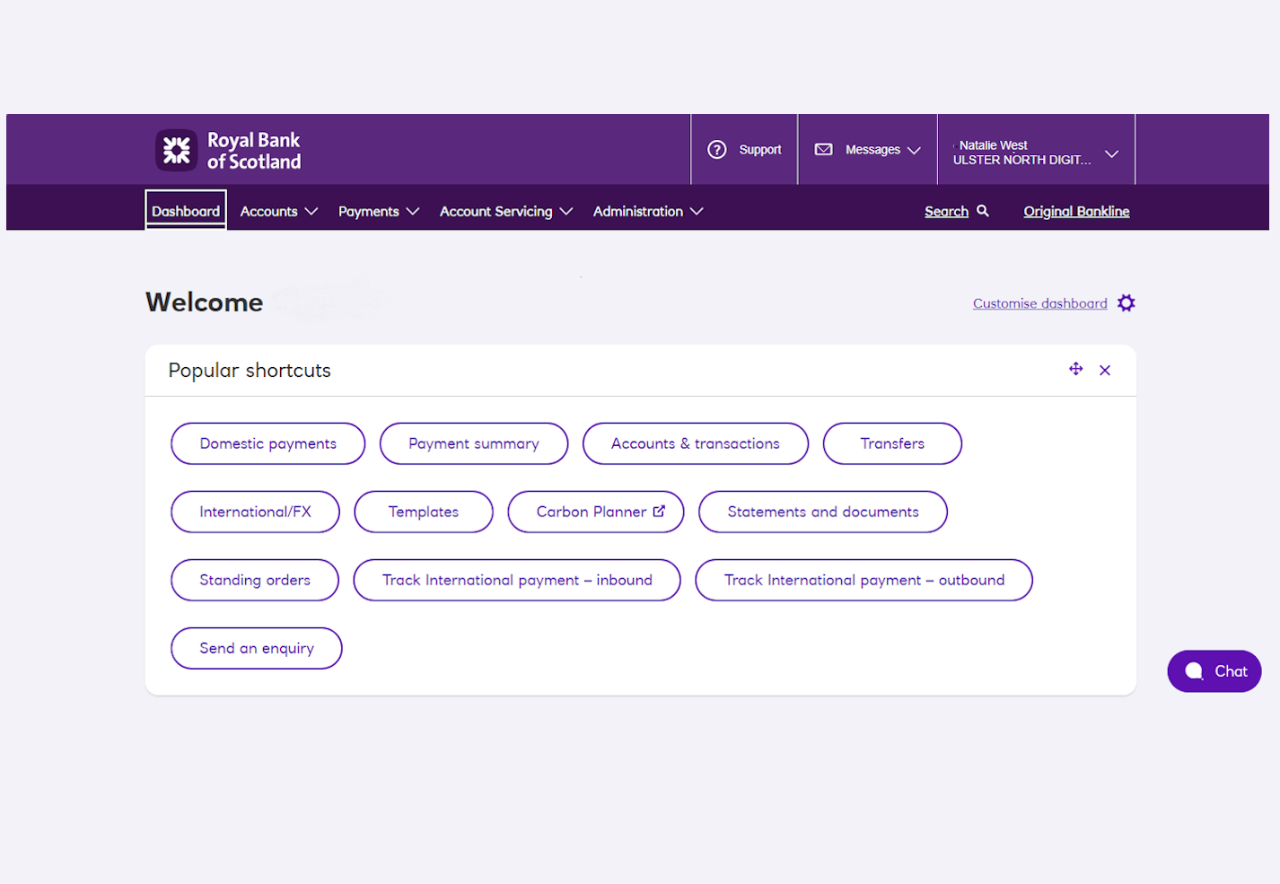

Dashboard

This is the page where you’ll land when you log in. It’s your gateway to all parts of Bankline. And you can make it your own:

Shuffle the order of panels, or remove them altogether.

We’ll let you know here when new features are available.

Dashboard

This is the page where you’ll land when you log in. It’s your gateway to all parts of Bankline. And you can make it your own:

Shuffle the order of panels, or remove them altogether.

We’ll let you know here when new features are available.

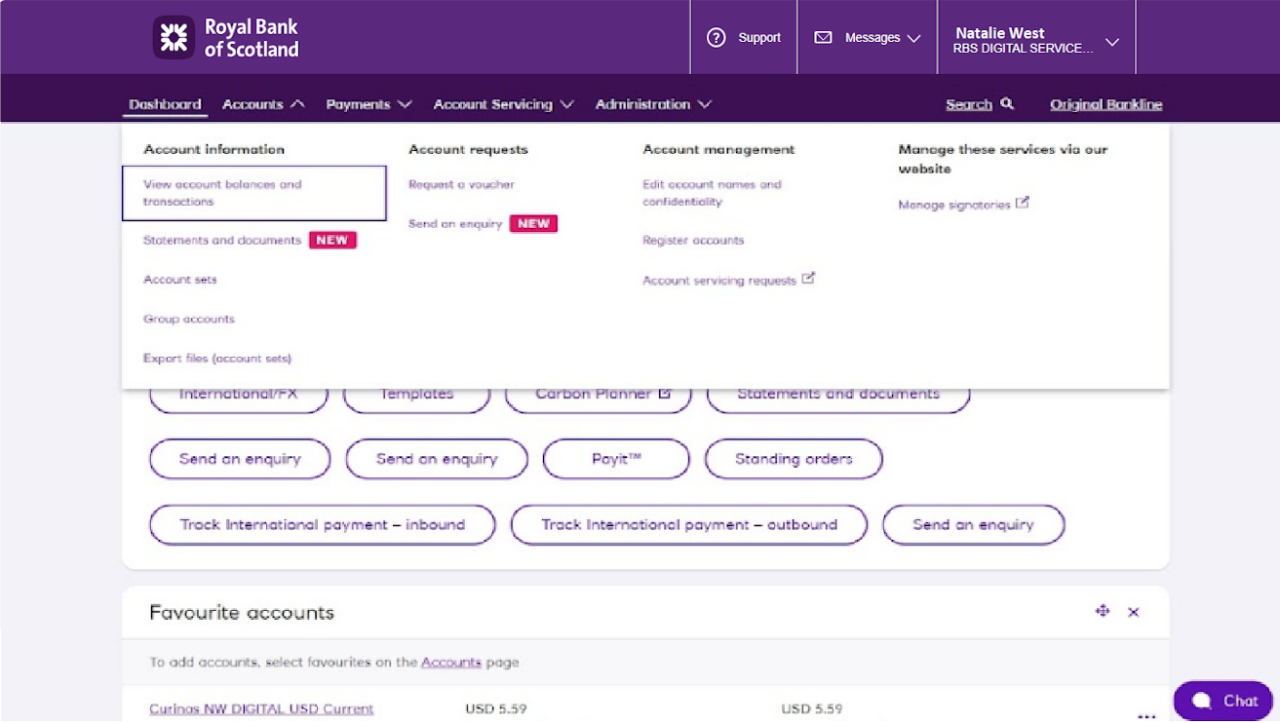

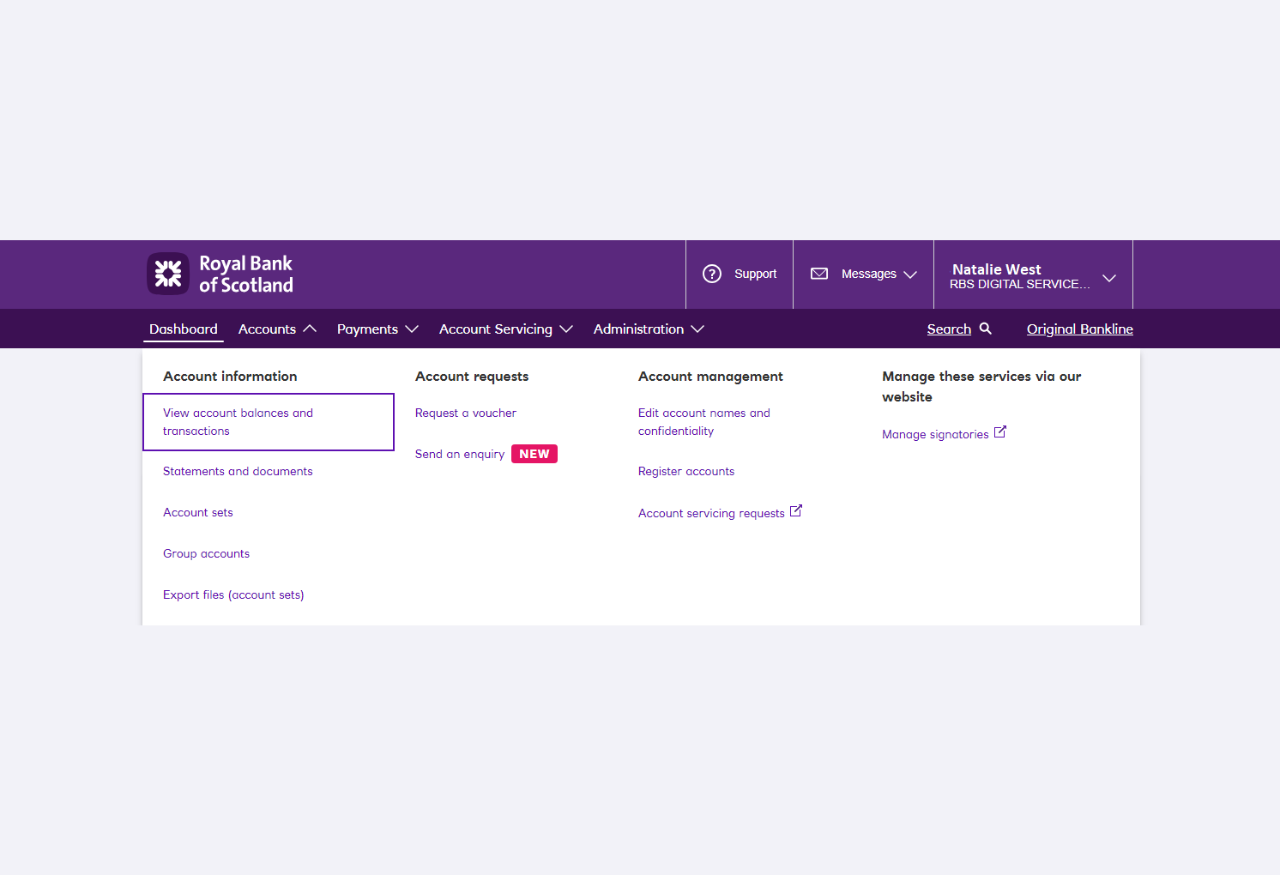

Accounts

This is where you go to view and manage your accounts in Bankline. You’ll be able to:

View account balances and transactions and download statements.

Add accounts.

Group your accounts into account sets – useful for reporting.

Manage your accounts by editing their names and confidential status.

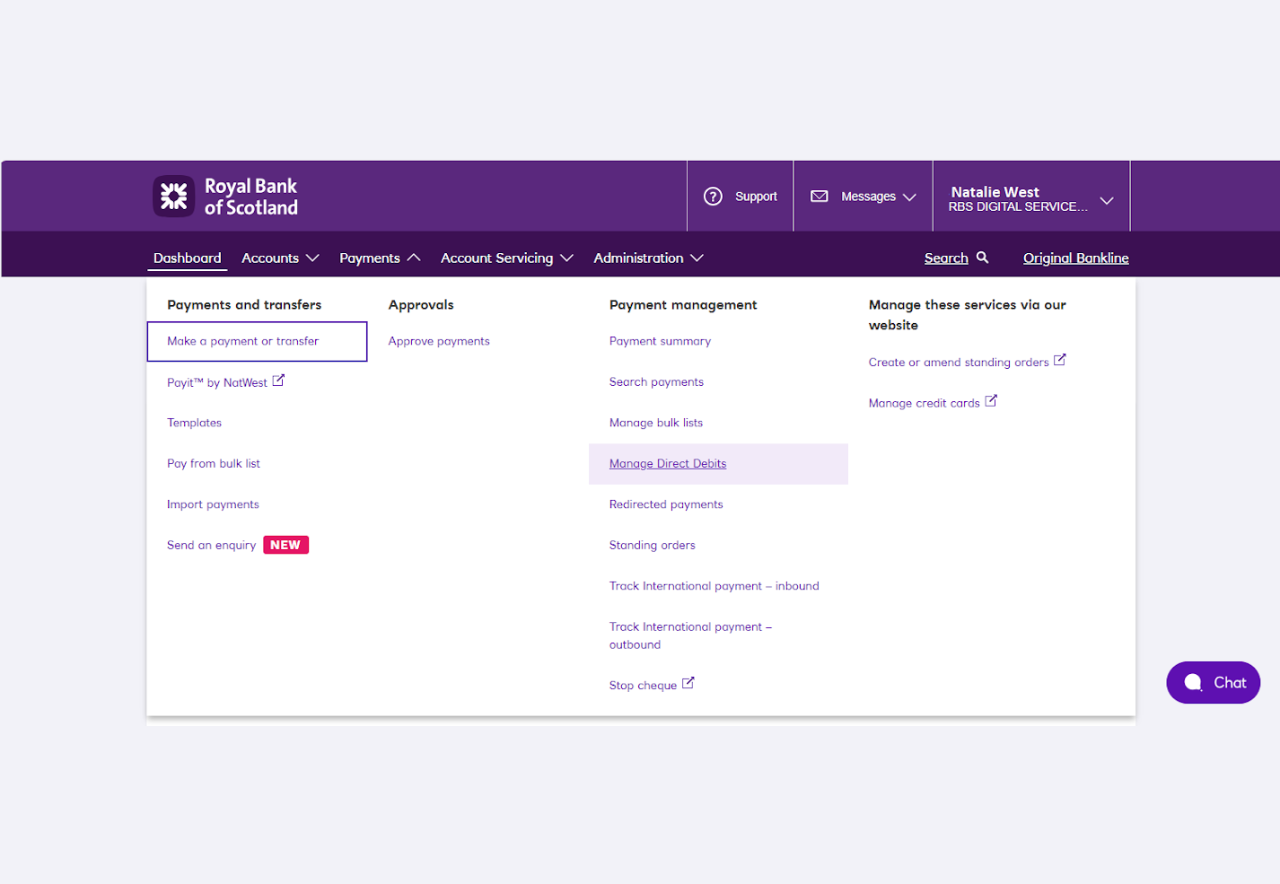

Payments

From here you can make, approve and manage payments.

If you have the right permissions, you can make domestic UK payments and international payments. You can also make transfers between your own accounts, including currency accounts if you have them.

You can make single payments, bulk payments, and pay your regular payees from saved templates. You can also import payment files to save you time. More about these options later.

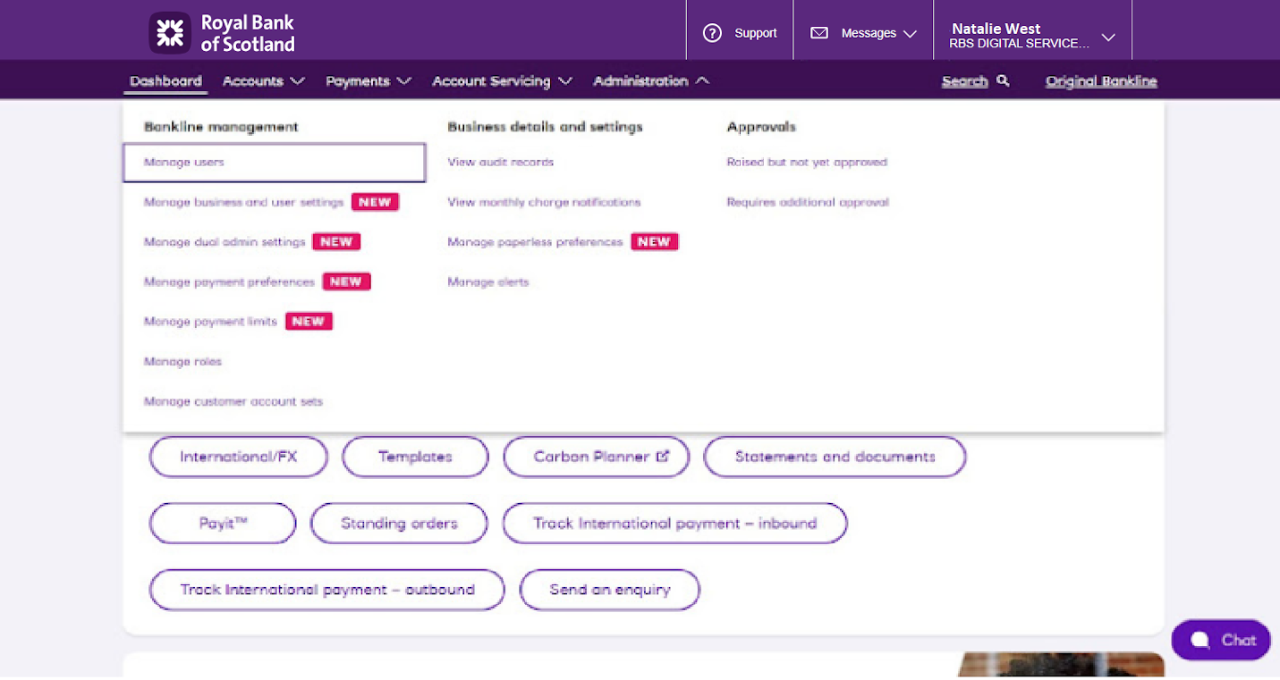

Administration

From this section administrators can add and manage users and make changes to profile-level settings like payment limits and payment preferences.

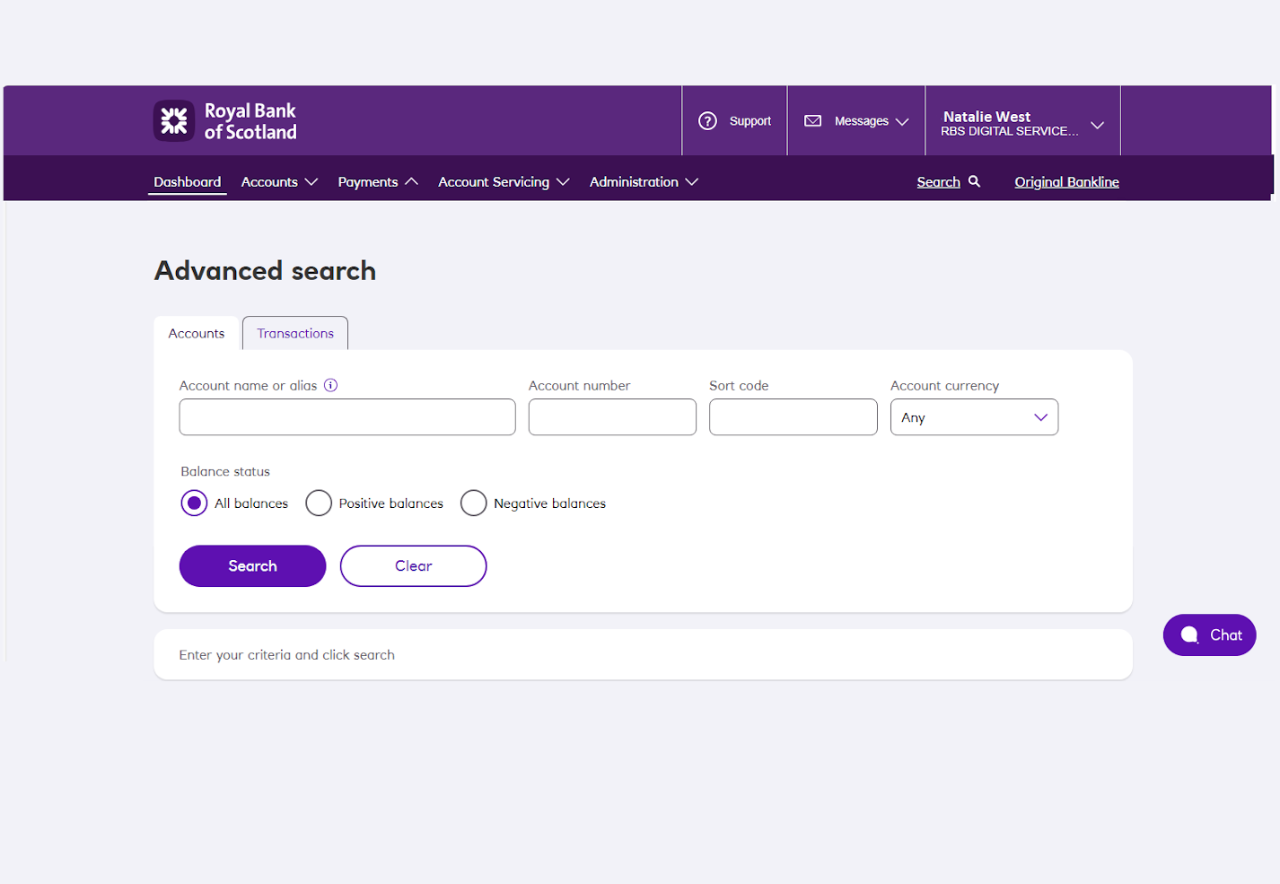

Search

If you want to search for any accounts or transactions in Bankline, look no further.

Transaction search includes completed transactions that go into or come out of your accounts.

Account servicing

Account servicing lets you make everyday banking requests in Bankline without having to pick up the phone.

These requests include things like:

- Stopping cheques

- Ordering cheque books and paying in books.

- Opening and closing accounts.

- Changing statement and principle addresses with the bank

Any account servicing request raised across Bankline can be found and tracked here.

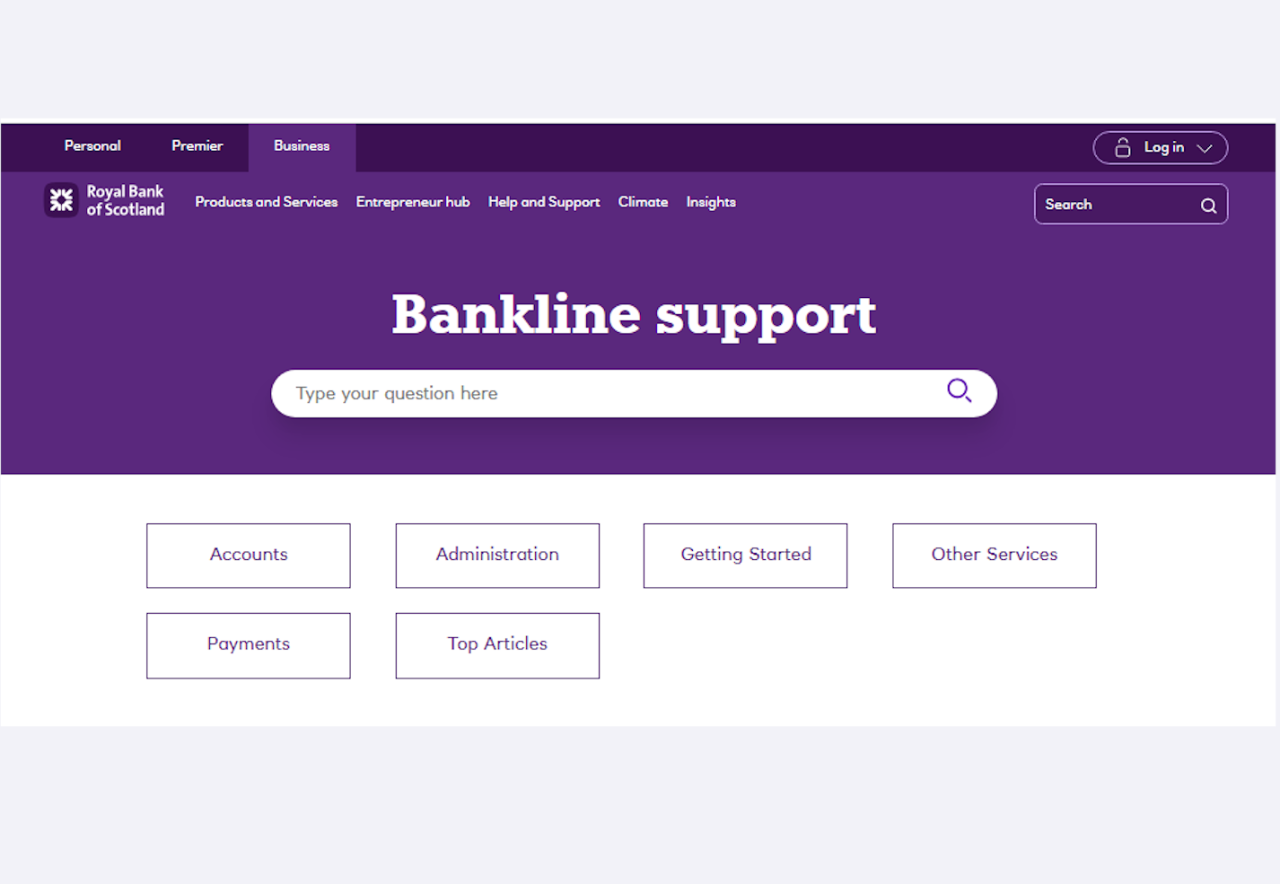

Support

Got a question, or not sure how to do something? Just click Support to search our ‘how-to’ FAQ articles.

Cora and webchat

Prefer a chat? Click ‘Chat now’ and Cora, your digital assistant, will help with your query and connect you to a webchat adviser if needed.

Cora is online 24/7 and our advisers are available 9 to 5, Monday to Friday, excluding public holidays.

To get through to an adviser at any point, just type ‘speak to a person’.

3. Sign up for a webinar

The best way to get to know Bankline is to join one of our free live webinars with a Bankline specialist.

Our ‘Making payments’ webinar imight be the most useful option. If you have administration access, then the ‘Managing users’ and ‘Security settings’ webinars may also be relevant.

View upcoming Bankline webinars

We recommend booking on a session that's scheduled for the first week you have access to Bankline.

We also recommend signing up to a fraud awareness webinar. They're not Bankline specific, but it will help you and your business spot common threats and stay safe online.